Small Business Owner’s Guide to Mastering Financial Management Terminology: A Comprehensive Approach

Are you a small business owner feeling overwhelmed by financial terminology for entrepreneurs? You’re not alone.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience guiding clients through financial planning for small businesses, I often encounter this common struggle.

In this article, you’ll discover strategies to master financial terminology, including:

- Creating a glossary of essential financial terms

- Understanding key financial statements, such as profit and loss statements and balance sheets for beginners

- Applying terms in real scenarios, like cash flow management and budgeting techniques for entrepreneurs

Let’s dive into these small business accounting basics.

Understanding the Misunderstandings

Navigating financial terminology for entrepreneurs is like trying to decode a foreign language for many small business owners. This confusion often leads to costly mistakes, such as misinterpreting financial statements or misunderstanding key metrics in financial planning for small businesses.

Several clients have shared their frustration over terms like ROI and cash flow, which can seem like a maze in cash flow management tips for entrepreneurs.

When these terms aren’t clear, it’s easy to make poor financial decisions. For instance, mixing up corporate finance with managerial finance can disrupt your business strategy and impact your profit and loss statement.

As a result, growth stalls, and opportunities slip through the cracks, highlighting the importance of understanding financial terminology for entrepreneurs.

In my experience, people often find that a lack of clarity in financial language directly hinders their ability to manage finances effectively. This confusion is not just an inconvenience; it’s a roadblock to your business’s success and underscores the need for mastering small business accounting basics.

Roadmap to Mastering Financial Terminology for Entrepreneurs

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in understanding financial terminology for entrepreneurs and small business accounting basics.

- Create a financial terminology glossary: Compile, organize, and regularly update a glossary of key financial terms, including those related to financial planning for small businesses and profit and loss statement explanations.

- Learn key financial statements and ratios: Enroll in courses, study financial statements like balance sheets for beginners, and understand important financial ratios for small companies.

- Practice applying terms in real scenarios: Role-play scenarios involving cash flow management tips, use terms in daily operations, and join financial discussions about budgeting techniques for entrepreneurs and tax deductions for small business owners.

Let’s dive into mastering financial terminology for entrepreneurs!

1: Create a financial terminology glossary

Creating a financial terminology glossary is your first step to mastering financial terminology for entrepreneurs. This resource is essential for understanding small business accounting basics and financial planning for small businesses.

Actionable Steps:

- Compile a list of the most common financial terms. Aim to identify and define at least 50 key terms, including those related to profit and loss statements and balance sheets for beginners.

- Organize terms into categories, such as corporate finance and managerial finance. Ensure each category has a minimum of 10 terms, covering areas like cash flow management tips and business credit management.

- Regularly review and update the glossary. Set a monthly reminder to add new terms and verify existing definitions, including financial ratios for small companies and tax deductions for small business owners.

Key benefits of a financial terminology glossary for entrepreneurs:

- Enhances understanding of complex terms related to budgeting techniques for entrepreneurs

- Boosts confidence in financial discussions and bookkeeping best practices for startups

- Keeps you updated with industry trends in financial terminology for entrepreneurs

Explanation: A glossary helps you understand complex terms and boosts your confidence in financial discussions.

By categorizing and regularly updating your glossary, you stay current with industry trends.

For example, Investopedia offers comprehensive definitions to get you started.

This glossary will be your go-to resource as you continue to learn and apply financial terminology for entrepreneurs.

2: Learn key financial statements and ratios

Understanding key financial statements and ratios is essential for making informed business decisions and mastering financial terminology for entrepreneurs.

Actionable Steps:

- Enroll in a financial management course: Sign up for an online course that covers financial statements and small business accounting basics. Aim to complete it within a month.

- Study and interpret financial statements: Dedicate 2 hours per week to understanding the income statement, balance sheet, and cash flow statement, focusing on financial planning for small businesses.

- Calculate and analyze financial ratios: Practice calculating ratios like ROI and profit margins quarterly to assess your business’s performance and improve cash flow management.

Explanation: These steps help you grasp crucial financial concepts, boosting your confidence and decision-making in financial terminology for entrepreneurs.

For example, Investopedia provides excellent resources to start learning. This knowledge will enable you to spot trends and make data-driven decisions using budgeting techniques for entrepreneurs.

Essential financial statements to master:

- Income Statement (profit and loss statement explained)

- Balance Sheet (balance sheet for beginners)

- Cash Flow Statement

- Statement of Changes in Equity

By mastering financial statements and ratios, you set a strong foundation for your business’s financial stability and improve your understanding of financial terminology for entrepreneurs.

3: Practice applying terms in real scenarios

Applying financial terminology for entrepreneurs in real-life situations solidifies your understanding and boosts your confidence.

Actionable Steps:

- Role-play financial scenarios: Team up with a mentor or peer to simulate financial decision-making. Conduct one role-play session per week, focusing on financial planning for small businesses.

- Use terms in daily operations: Integrate at least five new financial terms into your business vocabulary each month, including cash flow management tips and small business accounting basics.

- Join financial forums: Participate in online discussions and contribute to at least two forums per month, exploring topics like profit and loss statement explained and balance sheet for beginners.

Explanation: Practicing financial terminology for entrepreneurs in real scenarios helps you internalize and apply them effectively. This hands-on approach not only improves your confidence but also enhances your decision-making skills in areas such as budgeting techniques for entrepreneurs.

For example, engaging with peers in forums like Investopedia can provide valuable insights and practical knowledge on topics like tax deductions for small business owners.

Ways to reinforce your financial terminology:

- Create flashcards for quick review of business credit management terms

- Teach concepts like financial ratios for small companies to colleagues or friends

- Write blog posts explaining financial terminology for entrepreneurs

Mastering financial terminology through practice empowers you to make informed business decisions and achieve financial stability. This includes understanding bookkeeping best practices for startups and other essential aspects of small business finance.

Partner with Alleo on Your Financial Management Journey

We’ve explored the challenges of mastering financial terminology for entrepreneurs and how solving them can benefit your business. But did you know you can work directly with Alleo to make this journey easier and faster?

Alleo offers tailored coaching support to help you master financial terminology for entrepreneurs. Setting up an account is simple, whether you’re focusing on financial planning for small businesses or learning small business accounting basics.

Once you create a personalized plan, Alleo’s AI coach will guide you through each step, from understanding profit and loss statements to implementing effective budgeting techniques for entrepreneurs. The coach will follow up on your progress and handle any changes in your financial management journey.

You’ll stay accountable through text and push notifications, ensuring you stay on top of essential topics like cash flow management tips and business credit management.

Ready to get started for free and dive into financial terminology for entrepreneurs? Let me show you how!

Step 1: Log In or Create Your Account

To begin mastering financial terminology with Alleo’s AI coach, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing a consistent approach to managing financial terminology, which will help you overcome confusion and make better business decisions.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to directly address your challenges with financial terminology and management, aligning perfectly with your goal of mastering business finance concepts for improved decision-making and growth.

Step 4: Starting a coaching session

Begin your financial management journey with Alleo by scheduling an initial intake session, where you’ll work with your AI coach to create a personalized plan tailored to your business’s financial terminology needs.

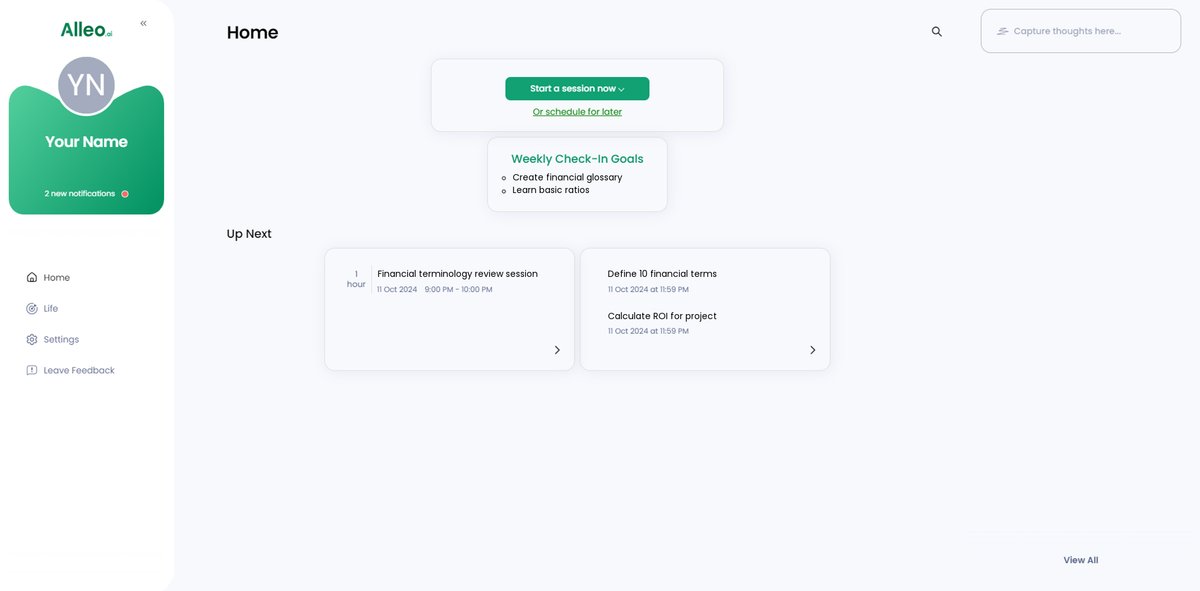

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to review and manage the financial management goals you discussed, keeping you on track with your journey to master financial terminology.

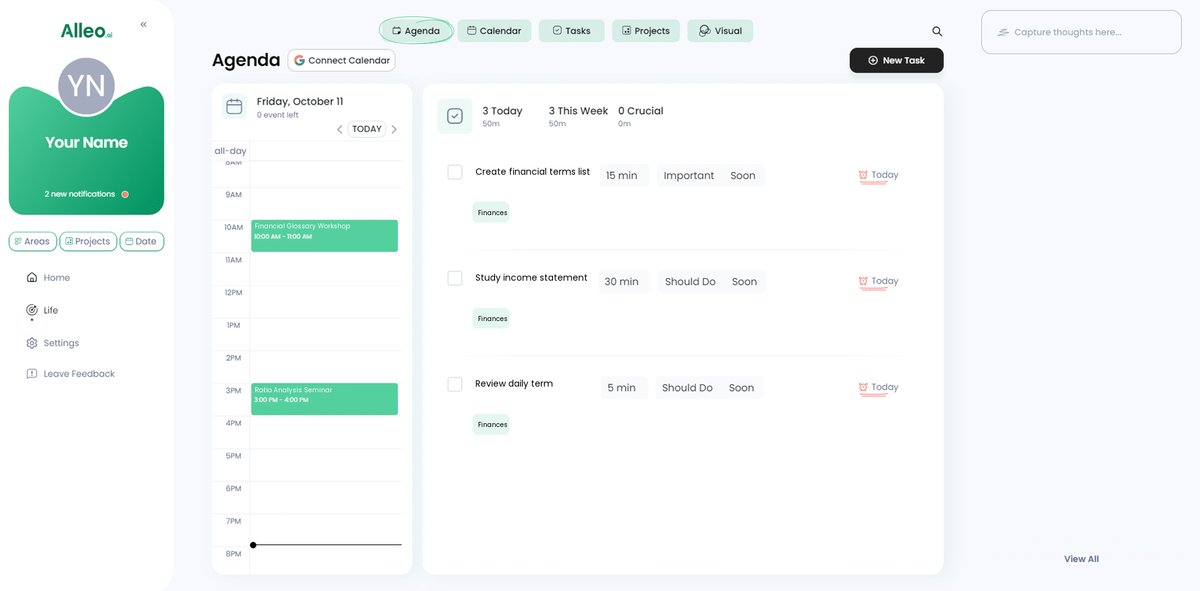

Step 6: Adding events to your calendar or app

Track your progress in mastering financial terminology by adding key learning milestones and practice sessions to your calendar or task app, allowing you to stay accountable and monitor your journey towards financial fluency.

Take Control of Your Financial Understanding

With these strategies, you can overcome the confusion surrounding financial terminology for entrepreneurs and improve your financial planning for small businesses.

Remember, mastering financial terms is crucial for making informed decisions and ensuring your business’s success. Creating a glossary of small business accounting basics, learning key financial statements like profit and loss statements and balance sheets for beginners, and practicing real scenarios are your steps to clarity in cash flow management.

It’s time to take action. You have the tools and resources; now, put them to use in implementing budgeting techniques for entrepreneurs.

And don’t forget, Alleo is here to help you on this journey. Our AI coach can guide you through mastering financial management terminology and understanding financial ratios for small companies.

Start today. Take control of your financial future and achieve the growth you deserve by improving your business credit management and exploring tax deductions for small business owners.