6 Strategic Steps to Adapt Pricing for Fluctuating Interest Rates

Are you struggling to keep up with changing interest rates and their impact on your business pricing strategies? Adapting pricing to interest rates is a critical skill in today’s market.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience assisting clients with business strategy, I often encounter issues related to interest rate forecasting and dynamic pricing models.

In this article, you’ll discover proven strategies to adapt your pricing models amidst fluctuating interest rates. We’ll explore dynamic pricing, market research, financial derivatives, and more. From inflation-adjusted pricing to yield curve analysis, we’ll cover essential techniques for adapting pricing to interest rates.

Let’s dive in and explore how to manage market volatility impact on pricing and implement effective competitive pricing strategies.

The Challenge of Adapting to Fluctuating Interest Rates

Navigating the complexities of fluctuating interest rates can be overwhelming. Many clients initially struggle to maintain competitive pricing strategies while protecting their cash flow when adapting pricing to interest rates.

Interest rate changes can significantly affect your business’s cash flow and profitability. I’ve seen several small business owners find it challenging to balance these fluctuations with their operational needs, often requiring interest rate forecasting and financial risk management.

For instance, one common issue is the impact on loan repayments and cost of capital adjustments. This can lead to tough decisions about where to cut costs or how to adjust dynamic pricing models.

In my experience, businesses often face reduced profit margins due to higher borrowing costs. This makes it crucial to adopt strategies that safeguard financial stability, such as inflation-adjusted pricing and interest rate hedging techniques.

Understanding the pain points in these scenarios helps to appreciate the need for effective solutions. Let’s explore how to tackle these challenges head-on, considering market volatility impact on pricing and yield curve analysis.

Strategic Roadmap for Adapting Pricing Strategies

Overcoming this challenge of adapting pricing to interest rates requires a few key steps. Here are the main areas to focus on to make progress.

- Implement dynamic pricing strategies: Use AI tools to adjust prices in real-time based on market volatility impact on pricing and interest rate changes.

- Conduct regular market research and analysis: Stay informed about interest rate forecasting trends through industry reports, yield curve analysis, and customer surveys.

- Utilize financial derivatives for risk hedging: Implement derivatives like interest rate swaps and other interest rate hedging techniques to mitigate risks.

- Offer flexible financing options to customers: Develop options like adjustable-rate loans or installment plans for rate-sensitive products.

- Optimize capital allocation and cost management: Reallocate capital to high-impact areas and reduce unnecessary expenses, considering cost of capital adjustments.

- Develop data-driven forecasting models: Use historical data for forecasting market trends and adapting pricing to interest rates.

Let’s dive in!

1: Implement dynamic pricing strategies

Adapting pricing to interest rates is essential for maintaining competitive pricing in changing market conditions.

Actionable Steps:

- Use AI-powered tools to adjust prices in real-time based on market data and interest rate forecasting.

- Regularly update your dynamic pricing models to reflect changes in interest rates and competitor pricing strategies.

- Train your sales team to communicate the benefits of interest rate-sensitive products and inflation-adjusted pricing to customers transparently.

Explanation:

Dynamic pricing allows you to stay competitive by adapting pricing to interest rates and market volatility. This approach helps safeguard your cash flow and profitability through effective financial risk management.

According to Deloitte, businesses must adapt to economic uncertainties and market dynamics to thrive.

Key benefits of dynamic pricing include:

- Increased revenue through optimal pricing and cost of capital adjustments

- Better inventory management

- Enhanced competitiveness in the market through yield curve analysis

Implementing these strategies ensures your business remains agile and responsive to changes in interest rates and market conditions.

Let’s move on to the next strategy.

2: Conduct regular market research and analysis

Regular market research and analysis are crucial to stay ahead in a fluctuating interest rate environment and for adapting pricing to interest rates.

Actionable Steps:

- Subscribe to industry reports and economic forecasts to stay updated on interest rate trends and improve interest rate forecasting.

- Conduct customer surveys to understand their sensitivity to price changes and financing preferences, which can inform dynamic pricing models.

- Attend industry conferences and networking events to gain insights on market volatility impact on pricing and form valuable partnerships.

Explanation:

Conducting regular market research helps you stay informed on trends and customer preferences. This knowledge allows you to make strategic decisions that align with market conditions and adapt your pricing to interest rates effectively.

According to Deloitte, businesses must adapt to economic uncertainties and market dynamics to thrive. By staying proactive, you’ll better navigate interest rate changes and maintain competitiveness through financial risk management and competitive pricing strategies.

By following these steps, you can ensure your business remains agile and responsive to changes. Let’s move on to the next strategy.

3: Utilize financial derivatives for risk hedging

Using financial derivatives is crucial for managing the impact of fluctuating interest rates on your business and adapting pricing to interest rates.

Actionable Steps:

- Consult with a financial advisor to determine which derivatives, such as interest rate swaps or caps, suit your business’s needs and support interest rate hedging techniques.

- Implement a risk management plan that incorporates the selected derivatives to mitigate interest rate fluctuations and manage financial risk.

- Monitor the performance of these financial instruments regularly and adjust your strategy as needed, considering market volatility impact on pricing.

Explanation:

These steps help protect your business from adverse interest rate changes. By using derivatives, you can stabilize costs and maintain profitability while adapting pricing to interest rates.

According to RSM, adapting to higher capital costs is essential for business resilience in a volatile financial environment.

Common types of financial derivatives for risk hedging:

- Interest rate swaps

- Forward rate agreements

- Interest rate options

Taking these actions ensures your business can handle interest rate changes effectively and adapt pricing strategies accordingly. Let’s move on to the next strategy.

4: Offer flexible financing options to customers

Offering flexible financing options to customers is essential for adapting pricing to interest rates and attracting and retaining price-sensitive clients during periods of fluctuating interest rates.

Actionable Steps:

- Develop adjustable-rate loans: Create and promote loans with adjustable rates that can appeal to customers who are wary of future interest rate changes, incorporating interest rate forecasting techniques.

- Partner with financial institutions: Collaborate with banks or credit unions to offer customized financing packages tailored to your customers’ needs, considering market volatility impact on pricing.

- Introduce installment payment plans: Offer installment plans that allow customers to spread out large payments over time, easing their financial burden and adapting pricing to interest rates.

Explanation:

These steps help attract customers by offering financial flexibility, which is crucial during uncertain economic times and when adapting pricing to interest rates.

According to Deloitte, businesses must adapt to economic uncertainties and market dynamics to thrive.

By implementing flexible financing options and dynamic pricing models, you’ll increase customer satisfaction and loyalty, ultimately boosting your sales and profitability.

Taking these actions ensures your business can better serve its customers and remain competitive in the face of changing interest rates.

Let’s move on to the next strategy.

5: Optimize capital allocation and cost management

Optimizing capital allocation and cost management is crucial for maintaining profitability during fluctuating interest rates, especially when adapting pricing to interest rates.

Actionable Steps:

- Implement cost-control measures: Identify and eliminate unnecessary expenses to improve operational efficiency and manage financial risk.

- Reallocate capital: Focus investments on high-impact areas like technology upgrades or marketing to drive growth, considering cost of capital adjustments.

- Regularly review financials: Analyze financial statements and performance metrics to find further optimization opportunities, including yield curve analysis.

Explanation:

These steps help ensure your business remains financially stable and competitive. For example, reallocating capital to impactful areas can mitigate the effects of interest rate changes and support dynamic pricing models.

According to RSM, adapting to higher capital costs is essential for business resilience in a volatile financial environment, which includes adapting pricing to interest rates.

Optimizing your capital and cost management will position your business for long-term success and help in developing competitive pricing strategies. Let’s move on to the next strategy.

6: Develop data-driven forecasting models

Developing data-driven forecasting models is crucial for anticipating market trends and adapting pricing to interest rates accordingly. These models are essential for effective financial risk management and dynamic pricing strategies.

Actionable Steps:

- Analyze historical data: Use your business’s past performance metrics to identify patterns and predict future market conditions, including interest rate forecasting.

- Integrate advanced analytics tools: Employ tools that leverage machine learning to refine your forecasts continuously and adjust for market volatility impact on pricing.

- Incorporate external economic indicators: Enhance your models with data from reliable sources to ensure comprehensive analyses, including yield curve analysis and inflation-adjusted pricing considerations.

Explanation:

These steps are important because they provide a foundation for making informed strategic decisions. By leveraging data-driven forecasting, you can stay ahead of interest rate changes and maintain profitability through effective pricing strategies adapted to interest rates.

According to Investopedia, forecasting uses historical data to predict future trends, which is essential for effective business planning and adapting pricing to interest rates.

Key components of effective data-driven forecasting:

- Accurate and relevant historical data for interest rate forecasting

- Robust statistical models for dynamic pricing

- Regular model validation and updates to reflect cost of capital adjustments

Implementing these strategies will position your business to anticipate and respond to market shifts efficiently, ensuring competitive pricing strategies that adapt to changing interest rates.

Partner with Alleo to Navigate Interest Rate Changes

We’ve explored adapting pricing strategies amidst fluctuating interest rates. Did you know you can work directly with Alleo to make adapting pricing to interest rates easier?

Alleo provides personalized coaching to help you tackle this challenge of adapting pricing to interest rates. Setting up an account for interest rate forecasting and financial risk management is quick and easy.

Create a personalized plan tailored to your business needs, including dynamic pricing models and inflation-adjusted pricing strategies.

Alleo’s AI coach offers full coaching sessions, just like a human coach. You’ll receive actionable advice, reminders, and analytical tools for yield curve analysis and cost of capital adjustments.

The coach follows up on your progress, handles changes in market volatility impact on pricing, and keeps you accountable via text and push notifications.

Ready to get started with adapting pricing to interest rates for free?

Let me show you how to implement competitive pricing strategies and interest rate hedging techniques!

Step 1: Log In or Create Your Account

To start adapting your pricing strategies with Alleo’s AI coach, log in to your account or create a new one to access personalized guidance on navigating interest rate changes.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to start tackling your business’s interest rate challenges head-on, aligning your personal growth with effective pricing strategies.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to get tailored guidance on adapting your pricing strategies to fluctuating interest rates, helping you maintain profitability and financial stability for your business.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your business challenges related to interest rate fluctuations and create a personalized plan to adapt your pricing strategies effectively.

Step 5: Viewing and Managing Goals After the Session

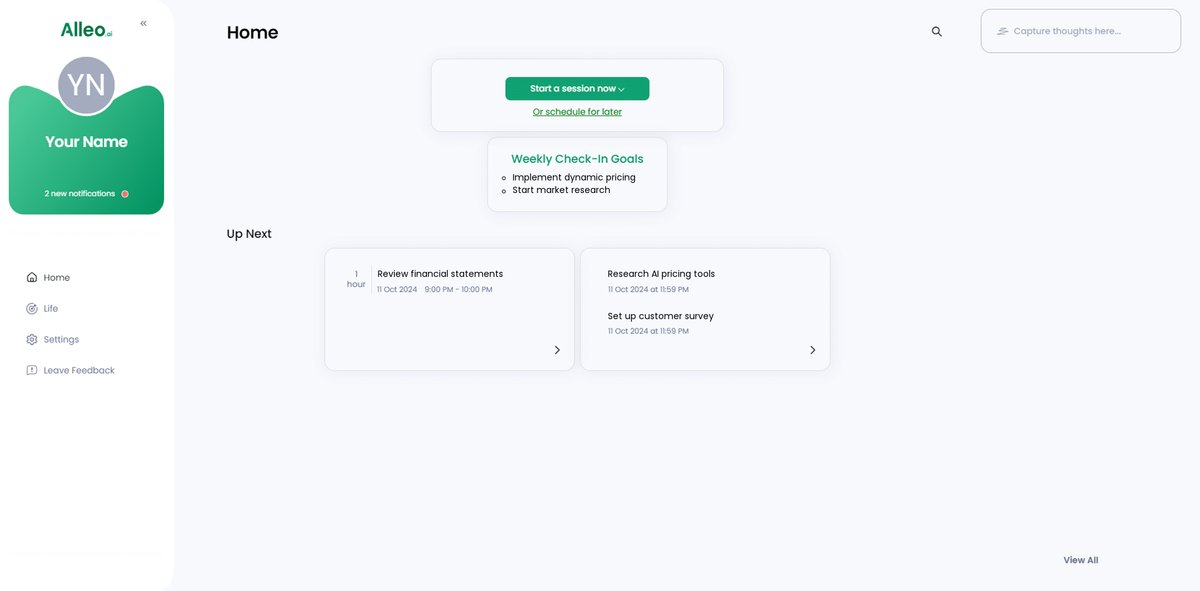

After your coaching session on adapting pricing strategies, check the Alleo app’s home page to view and manage the goals you discussed, helping you stay on track with implementing dynamic pricing and other financial strategies.

Step 6: Adding Events to Your Calendar or App

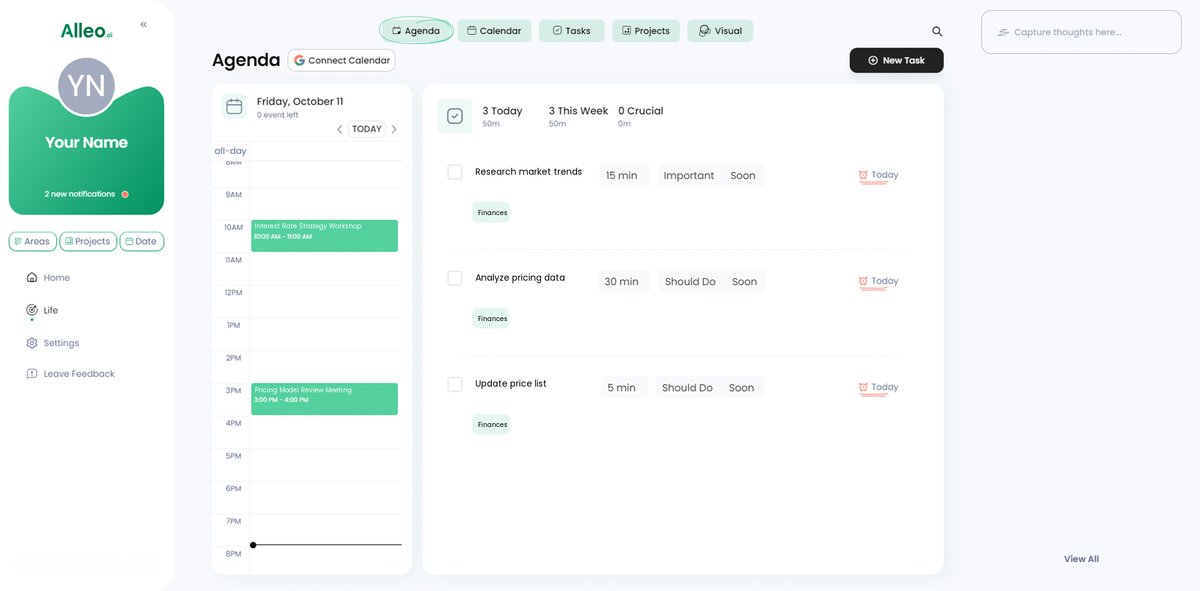

Use Alleo’s calendar and task features to track your progress in implementing pricing strategies, allowing you to stay organized and accountable as you adapt to changing interest rates.

Embrace Dynamic Strategies for Financial Success

Navigating interest rate changes can be daunting, but adapting pricing to interest rates is manageable with the right strategies.

By implementing dynamic pricing models, conducting market research, using financial derivatives for interest rate hedging, offering flexible financing, optimizing capital allocation, and developing interest rate forecasting models, you can stay competitive in the face of market volatility.

Remember, you’re not alone. Many small business owners face the same challenges in financial risk management.

With Alleo, you have a dedicated partner to guide you through these strategies, including inflation-adjusted pricing and yield curve analysis.

Take the first step toward financial stability and growth by adapting your pricing to interest rates.

Try Alleo today and see the difference it can make in managing rate-sensitive products and cost of capital adjustments.

You’ve got this!