3 Proven Methods to Avoid Costly Repairs When Investing in Out-of-State Real Estate for Beginners

What if you invested your savings into an out-of-state property, only to see unexpected repair costs drain your profits? Avoiding costly out-of-state property repairs is crucial for successful long-distance real estate investing.

As a life coach, I’ve guided many small business owners through similar challenges in remote real estate management. I’ve seen firsthand how unforeseen expenses can disrupt cash flow, emphasizing the importance of due diligence for long-distance real estate investments.

In this article, you’ll find actionable strategies to avoid costly out-of-state property repairs and maintain healthy cash flow. We’ll explore cost-effective maintenance strategies and discuss choosing reliable property managers for your distant investments.

Let’s dive in to learn how to mitigate risks in long-distance property investing!

Understanding the Financial Strain of Unexpected Repairs

Unexpected repairs can wreak havoc on your cash flow, especially when you’re trying to avoid costly out-of-state property repairs. For instance, hidden plumbing issues often lead to significant expenses in remote real estate management scenarios.

Imagine discovering a septic system failure just after closing a deal on an out-of-state property investment.

These issues are more common than you might think in long-distance property investing. Several clients initially struggle with outdated electrical systems and structural defects, which aren’t always evident during initial property inspections for distant investments.

These unexpected costs can quickly erode your profits. It’s not just the repair bills; it’s the time and effort taken away from other investments and the challenge of managing cost-effective maintenance strategies from afar.

The financial strain is real. Many business owners find themselves dipping into emergency funds or taking out loans to cover these unexpected expenses, highlighting the importance of due diligence for long-distance real estate.

This can lead to a cycle of debt and stress, emphasizing the need for choosing reliable property managers.

Addressing these problems proactively is crucial. It can prevent minor issues from becoming major financial burdens and help you avoid costly out-of-state property repairs in the long run.

A Roadmap to Avoid Costly Repairs in Out-of-State Real Estate

Overcoming this challenge requires a few key steps to avoid costly out-of-state property repairs. Here are the main areas to focus on for successful out-of-state property investment:

- Conduct Thorough Pre-Purchase Inspections: Hire a qualified inspector for property inspection for distant investments, attend the inspection, and request a detailed report.

- Research Local Property Management Companies: Evaluate multiple companies for remote real estate management, interview potential managers, and request a trial period.

- Set Up a Dedicated Maintenance Fund: Calculate expected costs for cost-effective maintenance strategies, automate fund contributions, and review annually to avoid costly out-of-state property repairs.

Let’s dive in to explore risk mitigation in long-distance property investing!

1: Conduct thorough pre-purchase inspections

Conducting thorough pre-purchase inspections is crucial in helping avoid costly out-of-state property repairs and ensuring a solid investment, especially for long-distance real estate.

Actionable Steps:

- Hire a qualified inspector: Engage an inspector experienced with older properties and out-of-state property investments. Verify their credentials and ask for references.

- Attend the inspection: Be present during the inspection, either in person or via virtual property tours for investors, to ask questions and gain insights. Take notes on potential issues.

- Request a detailed report: Obtain a comprehensive report covering all aspects of the property. Use the report to negotiate repairs or price reductions before purchasing, which is crucial for remote real estate management.

Key benefits of thorough inspections include:

- Early detection of potential issues in out-of-state properties

- Informed decision-making during purchase for distant investments

- Negotiation leverage for repairs or price adjustments in long-distance property investing

Explanation: Conducting detailed inspections helps you identify and address potential issues early, which is essential to avoid costly out-of-state property repairs. This proactive approach can prevent minor problems from becoming major expenses in remote real estate management.

According to Investopedia, thorough inspections are vital in safeguarding your investment and maintaining healthy cash flow, particularly for out-of-state property investments.

Taking these steps can save you from unexpected financial burdens, enabling you to focus on growing your investment portfolio and implementing cost-effective maintenance strategies for your distant real estate holdings.

2: Research local property management companies

Identifying reliable property management companies is crucial to managing out-of-state properties efficiently and helping avoid costly out-of-state property repairs.

Actionable Steps:

- Evaluate multiple companies: Research companies with a strong track record in managing out-of-state properties. Check online reviews and request client testimonials for remote real estate management.

- Interview potential managers: Ask about their experience, services, and fee structure. Inquire about their approach to handling repairs and maintenance for long-distance real estate.

- Request a trial period: Negotiate a trial management period to assess their performance. Monitor their responsiveness and effectiveness in managing the property to avoid costly out-of-state property repairs.

Explanation: Researching and selecting a competent property management company can help you avoid costly mistakes in out-of-state property investment. This proactive approach ensures your property is well-maintained and issues are addressed promptly.

According to Investopedia, proper management is key to maintaining healthy cash flow and safeguarding your investment.

Essential qualities to look for in a property management company:

- Proven track record with out-of-state properties

- Transparent communication and reporting for remote real estate management

- Efficient maintenance and repair processes to avoid costly out-of-state property repairs

Choosing the right property management company allows you to focus on other investments while ensuring your property is in good hands, reducing the risk of costly repairs in long-distance property investing.

3: Set up a dedicated maintenance fund

Creating a dedicated maintenance fund is essential for managing unexpected repair costs and maintaining healthy cash flow, especially when you want to avoid costly out-of-state property repairs.

Actionable Steps:

- Calculate expected costs: Estimate annual maintenance expenses based on the property’s age and condition. Use these estimates to set a realistic budget for your out-of-state property investment.

- Automate fund contributions: Set up automatic transfers from your rental income to ensure consistent contributions. Use financial software to track and manage the fund for effective remote real estate management.

- Review and adjust annually: Evaluate the fund’s adequacy at the end of each year. Adjust contributions based on actual expenses and future projections to maintain cost-effective maintenance strategies.

Explanation: Setting up a dedicated maintenance fund helps you prepare for unexpected expenses, ensuring you’re not caught off guard when managing distant investments.

According to Investopedia, proactive financial planning is crucial for maintaining healthy cash flow and protecting your investments. This approach allows you to focus on growing your portfolio without financial stress, even for long-distance property investing.

Key advantages of a maintenance fund include:

- Financial stability during unexpected repairs, helping avoid costly out-of-state property repairs

- Improved cash flow management for remote real estate management

- Peace of mind for property owners engaged in out-of-state property investment

By following these steps, you can safeguard your investment and maintain steady cash flow in your long-distance real estate ventures.

Partner with Alleo to Safeguard Your Real Estate Investments

We’ve explored the challenges of managing out-of-state real estate investments and the steps to avoid costly repairs. But did you know you can work directly with Alleo to make this journey easier and help avoid costly out-of-state property repairs?

Alleo provides tailored coaching support to help you manage your remote real estate investments effectively. With our AI coach, you get affordable, personalized guidance on cost-effective maintenance strategies and choosing reliable property managers, just like a human coach.

Plus, enjoy a free 14-day trial with no credit card required!

Setting up an account is simple. Create a personalized plan to address your specific challenges in long-distance property investing, including due diligence for long-distance real estate.

Our AI coach will follow up on your progress, handle changes, and keep you accountable with text and push notifications, helping you build a remote real estate network and mitigate risks in out-of-state property investment.

Ready to get started for free and learn how to avoid costly out-of-state property repairs?

Let me show you how!

Step 1: Log in or Create Your Account

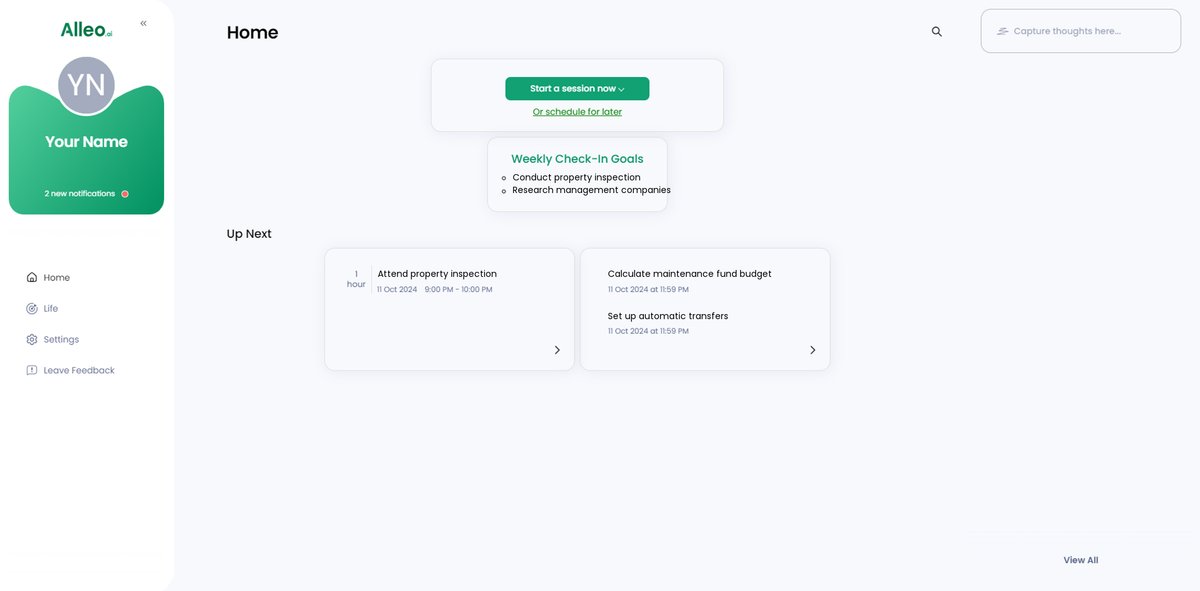

To start safeguarding your real estate investments with personalized AI coaching, Log in to your account or create a new one to begin your free 14-day trial with Alleo.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish consistent property management practices and financial discipline, helping you avoid unexpected repair costs and maintain healthy cash flow in your out-of-state real estate investments.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to get tailored guidance on managing your real estate investments, avoiding costly repairs, and maintaining healthy cash flow for your out-of-state properties.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan for managing your out-of-state real estate investments and avoiding costly repairs.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the goals you discussed, helping you stay on track with your real estate investment strategies.

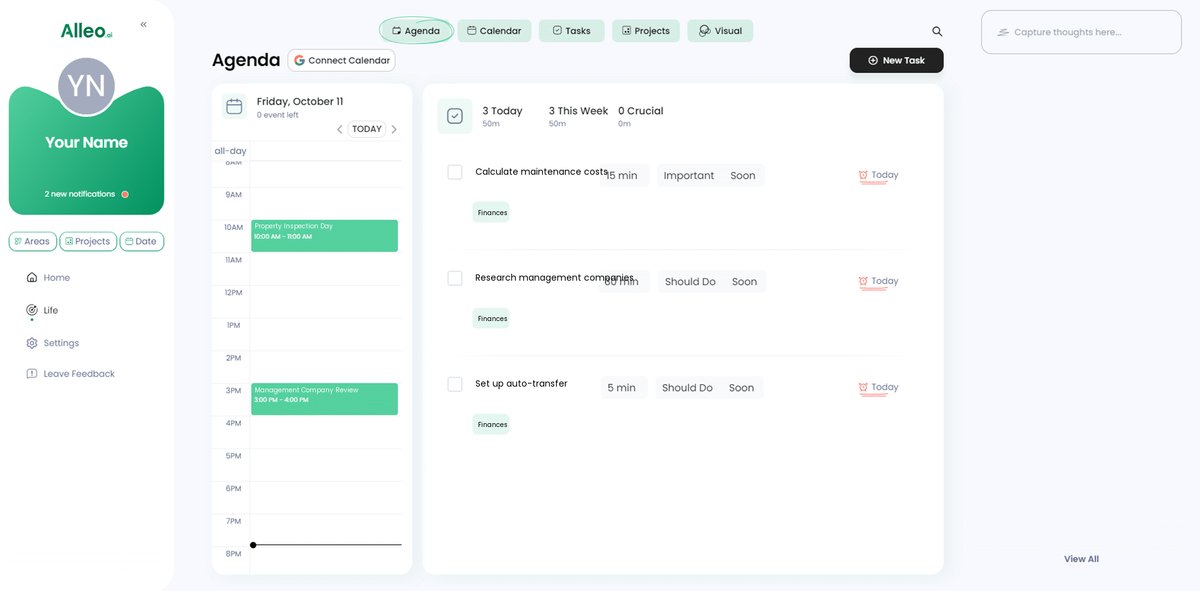

Step 6: Adding Events to Your Calendar or App

Use Alleo’s calendar and task features to schedule and track your progress on property inspections, management company research, and maintenance fund contributions, helping you stay organized and accountable in managing your out-of-state real estate investments.

Wrapping Up: Protecting Your Investment from Costly Repairs

So, you now have a roadmap to avoid costly out-of-state property repairs.

By conducting thorough inspections, researching property management companies for remote real estate management, and setting up a dedicated maintenance fund, you’re well on your way to successful out-of-state property investment.

Remember, these proactive steps can save you from financial strain and are crucial for risk mitigation in long-distance property investing.

I know it’s challenging, but taking these actions will protect your investments and ensure steady cash flow, especially when dealing with distant investments.

And don’t forget, Alleo is here to help. Our AI coach offers personalized guidance, making your real estate journey smoother and helping you avoid costly out-of-state property repairs.

So, why wait? Try Alleo for free and take control of your investments today, whether you’re managing properties remotely or exploring virtual property tours for investors!