How Entrepreneurs Can Diversify Income Streams: 4 Fundamental Principles to Reduce Financial Risk

Are you facing cash flow issues due to reliance on a single large payment source? It’s time to diversify business income streams to ensure financial stability for your startup.

As a life coach, I’ve helped many small business owners navigate these challenges and develop multiple revenue sources. I understand the vulnerability caused by external factors like government payment system changes, which is why risk management for entrepreneurs is crucial.

In this article, you’ll discover strategies to diversify business income streams and reduce financial risk. We’ll explore developing small-scale products, subscription models, affiliate marketing, and digital products as alternative income streams. These passive income strategies can help create an entrepreneurial income portfolio that’s more resilient to economic fluctuations.

Let’s dive into these recession-proof business ideas and discuss scaling business revenue through side hustles for business owners.

Understanding the Risks of Relying on a Single Income Source

Many entrepreneurs depend heavily on one primary revenue stream. This creates a fragile financial situation, highlighting the need to diversify business income streams.

For instance, small business owners often face cash flow issues due to delayed payments, emphasizing the importance of multiple revenue sources.

Imagine waiting for a single large payment while bills pile up. It’s stressful and risky, which is why exploring passive income strategies can be beneficial.

Any changes in government payment systems or client delays can disrupt your cash flow, making business income diversification crucial for risk management for entrepreneurs.

I’ve seen many clients struggle with this. They feel trapped and anxious, often wishing they had developed an entrepreneurial income portfolio.

Diversifying income streams can provide stability and peace of mind. It’s a strategy worth exploring to enhance financial stability for startups and established businesses alike.

Your Roadmap to Diversifying Income Streams

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to diversify business income streams and make progress:

- Develop multiple small-scale product offerings: Identify niche markets and create prototypes for testing, expanding your entrepreneurial income portfolio.

- Implement a subscription-based revenue model: Offer tiered subscription plans to generate recurring income, a crucial passive income strategy.

- Explore affiliate marketing partnerships: Partner with complementary businesses for mutual growth, creating alternative income streams.

- Create digital products with low overhead costs: Develop eBooks or online courses to reach a wider audience, an effective approach to scaling business revenue.

Let’s dive into these business income diversification strategies!

1: Develop multiple small-scale product offerings

Creating multiple small-scale product offerings can help stabilize your business by reducing dependency on one income source, which is crucial when you aim to diversify business income streams.

Actionable Steps:

- Identify niche markets: Research and find underserved niches in your industry. Track potential market size and demand to discover alternative income streams.

- Prototype and test products: Create MVPs (Minimum Viable Products) for quick market validation. Use customer feedback to refine offerings and build your entrepreneurial income portfolio.

- Scale successful products: Develop a scalable production plan to grow successful small-scale products. Monitor sales growth and customer satisfaction to ensure effective business income diversification.

Explanation: Diversifying your product offerings can help you tap into new markets and reduce financial risk, which is essential for risk management for entrepreneurs.

By continually testing and refining your products, you can ensure they meet market demands. This approach not only enhances stability but also opens up avenues for growth and helps in scaling business revenue.

For more insights on diversifying revenue streams, check out this guide on diversification.

Key benefits of diversifying product offerings:

- Reduced financial risk through multiple revenue sources

- Increased market reach and customer base

- Improved ability to adapt to changing market conditions, crucial for financial stability for startups

Taking these steps will set a strong foundation for a more resilient business. Let’s move on to implementing a subscription-based revenue model.

2: Implement a subscription-based revenue model

Implementing a subscription-based revenue model can provide a steady income stream, helping to diversify business income streams and reducing financial risk for your business.

Actionable Steps:

- Identify services suitable for subscription: List services that offer ongoing value, such as monthly consultations or exclusive content, to create multiple revenue sources.

- Develop tiered subscription plans: Create various subscription tiers, like basic, premium, and deluxe, to attract different customer segments and enhance your entrepreneurial income portfolio.

- Promote the subscription model to existing customers: Launch a targeted marketing campaign to convert current customers into subscribers, supporting business income diversification.

Explanation: Implementing a subscription model ensures consistent revenue, helping your business weather economic fluctuations and serving as one of the passive income strategies for risk management for entrepreneurs.

This strategy aligns with industry trends, as shown in this guide on diversification. By offering tiered plans, you cater to diverse customer needs and maximize potential revenue, contributing to financial stability for startups.

Transitioning to a subscription model can significantly enhance your financial stability. Now, let’s explore affiliate marketing partnerships as another way to diversify business income streams.

3: Explore affiliate marketing partnerships

Exploring affiliate marketing partnerships can help diversify business income streams by leveraging complementary businesses, creating alternative income streams for entrepreneurs.

Actionable Steps:

- Identify potential affiliate partners: Research businesses with products or services that complement yours. Evaluate their reach and relevance to enhance your entrepreneurial income portfolio.

- Set up an affiliate program: Develop a clear commission structure and create marketing materials. Track affiliate sign-ups and sales to boost multiple revenue sources.

- Monitor and optimize affiliate performance: Regularly review performance data and provide support to affiliates. Adjust strategies based on sales data to scale business revenue.

Explanation: Implementing these steps will help you tap into new revenue streams and reduce financial risk. By partnering with complementary businesses, you can reach a broader audience and enhance your income stability, contributing to business income diversification.

For more detailed guidance, check out this article on the benefits of affiliate marketing.

Essential elements of successful affiliate partnerships:

- Clear communication and expectations with partners

- Regular performance tracking and optimization

- Mutual benefit and alignment of goals

Now, let’s explore how creating digital products can further diversify your income and provide passive income strategies for business owners.

4: Create digital products with low overhead costs

Creating digital products with low overhead costs is an effective way to diversify business income streams and reduce financial risk.

Actionable Steps:

- Identify knowledge or skills to digitize: List expertise areas like eBooks or online courses. Evaluate market demand for these alternative income streams.

- Develop and launch digital products: Use platforms such as Teachable or Gumroad to create and sell your digital offerings. Track sales and customer feedback as part of your business income diversification strategy.

Explanation: Developing digital products allows you to reach a wider audience with minimal costs. This strategy aligns with trends in digital entrepreneurship and passive income strategies, as highlighted in this guide on diversification.

By leveraging your expertise, you can generate steady income and enhance financial stability for startups and established businesses alike.

Advantages of creating digital products:

- Scalable income potential with minimal ongoing costs, ideal for scaling business revenue

- Ability to reach a global audience, supporting multiple revenue sources

- Opportunity to establish thought leadership in your field, contributing to an entrepreneurial income portfolio

Diversifying through digital products is a smart move for long-term growth and can serve as one of many recession-proof business ideas. Now, let’s consider how Alleo can assist you in implementing these strategies to diversify business income streams.

Partner with Alleo to Diversify Your Income Streams

We’ve explored how diversifying business income streams can reduce financial risk. But did you know you can work directly with Alleo to make this journey easier and develop multiple revenue sources?

Create an account with Alleo, set up a personalized plan for business income diversification, and start working with our AI coach. Alleo will follow up on your progress, handle changes, and keep you accountable as you explore alternative income streams.

Our coach provides tailored support with full coaching sessions on passive income strategies and a free 14-day trial—no credit card required. We’ll help you build an entrepreneurial income portfolio.

Ready to get started for free and explore side hustles for business owners?

Let me show you how to diversify business income streams!

Step 1: Log In or Create Your Account

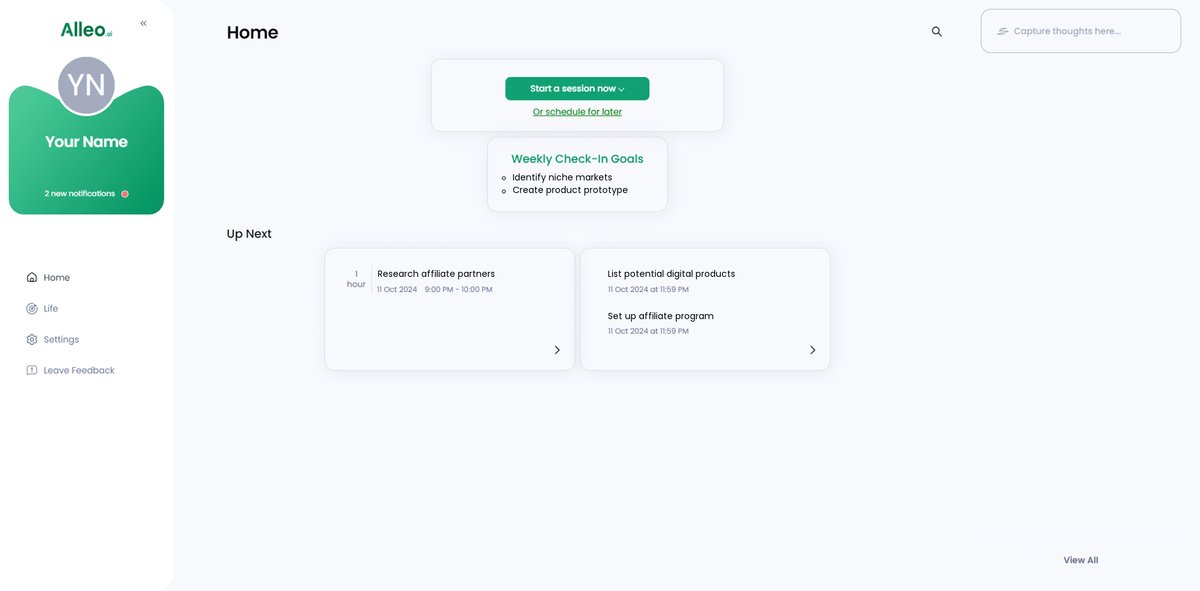

To start diversifying your income streams with Alleo’s AI coach, Log in to your account or create a new one to begin your journey towards financial stability.

Step 2: Choose Your Focus – Building Better Habits and Routines

Click on “Building better habits and routines” to start diversifying your income streams through consistent, productive actions that will help stabilize your cash flow and reduce reliance on a single payment source.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to directly address your cash flow challenges and develop strategies for income diversification, aligning perfectly with the goal of reducing reliance on a single payment source.

Step 4: Starting a coaching session

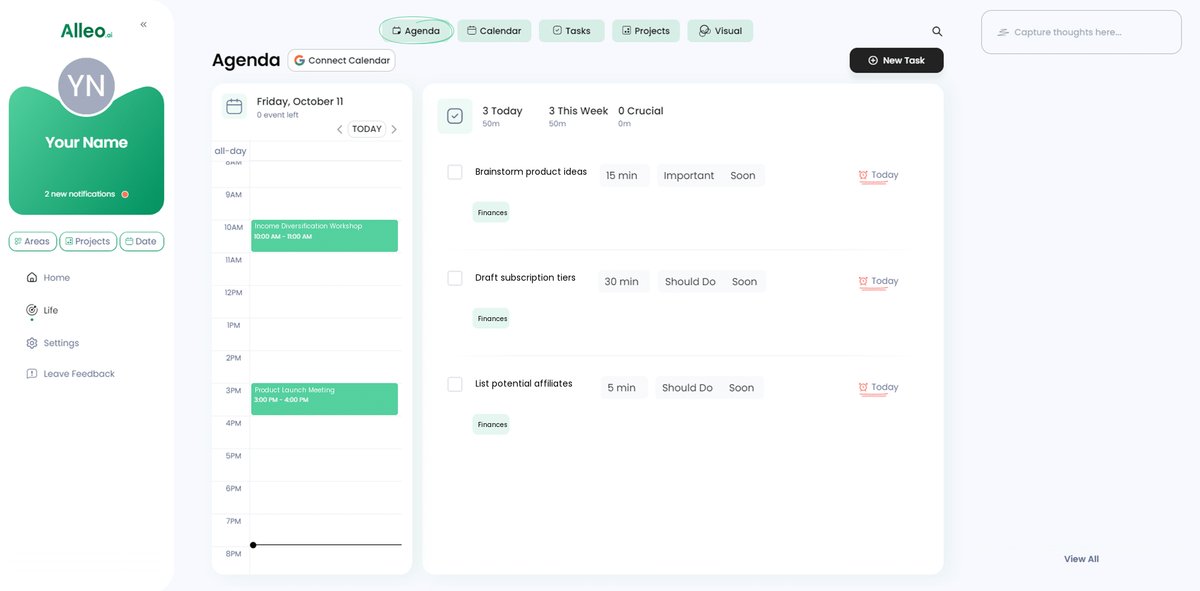

Begin your journey with Alleo by scheduling an intake session, where you’ll collaborate with our AI coach to create a personalized plan for diversifying your income streams and reducing financial risk.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, log into the Alleo app to view and manage the income diversification goals you discussed, which will be displayed on your home page for easy tracking and updates.

Step 6: Adding Events to Your Calendar or App

Use Alleo’s calendar and task features to schedule and track your progress on implementing income diversification strategies, helping you stay accountable and organized as you work towards financial stability.

Take Control of Your Financial Future

You now have a roadmap to diversify your business income streams. These passive income strategies can greatly enhance your financial stability and reduce risk for entrepreneurs.

Remember, diversifying income is not just a smart move—it’s essential for business income diversification. Implementing small-scale products, subscription models, affiliate marketing, and digital products can transform your business into an entrepreneurial income portfolio.

I understand the challenges you face in scaling business revenue. I’ve seen many small business owners struggle with similar issues when seeking alternative income streams.

But you don’t have to do it alone. Alleo can help guide you through each step of creating multiple revenue sources, ensuring you stay on track with your side hustles for business owners.

Start diversifying your income streams today with Alleo’s support. You’ve got this! Explore recession-proof business ideas and take control of your financial future.