How to Communicate Budget Concerns Effectively: 3 Essential Techniques for Finance Managers

Imagine your business is a ship navigating turbulent financial waters. Without effectively communicating budget concerns, your crew might not understand the severity of the storm ahead.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, clear communication is vital for financial transparency in management and fiscal responsibility.

In this article, I’ll share budget communication strategies to effectively communicate budget concerns, ensuring your team understands and acts on financial data. We’ll explore effective budget presentations and cost-cutting discussions.

Let’s dive into finance team leadership and stakeholder budget meetings.

The Communication Breakdown: Why It Matters

Clear communication is often the first casualty in financial turbulence. Many small businesses suffer when communicating budget concerns effectively becomes a challenge. This lack of clarity can lead to misinformed decisions and missed opportunities to mitigate cash flow issues.

In my experience, management and board members often don’t grasp the full extent of the financial situation, highlighting the need for improved budget communication strategies. This misunderstanding can result in inadequate proactive measures, leaving the business vulnerable to financial risks.

For example, several clients report that their teams were unprepared for a sudden financial downturn due to poor communication, emphasizing the importance of financial transparency in management.

Addressing these gaps is vital. Improved communication can significantly enhance your business’s financial stability and sustainability, particularly through effective budget presentations and stakeholder budget meetings.

Strategic Steps to Effective Budget Communication

Communicating budget concerns effectively requires a few key steps. Here are the main areas to focus on to make progress in budget communication strategies:

- Prepare clear, data-driven budget reports: Create detailed reports using software tools to ensure accuracy and clarity, enhancing financial transparency in management.

- Schedule regular financial update meetings: Set up monthly stakeholder budget meetings to review financial performance and discuss challenges, fostering fiscal responsibility communication.

- Use visuals to illustrate cash flow projections: Incorporate charts and infographics to make data more understandable, improving effective budget presentations and budget forecasting techniques.

Let’s dive in to explore these strategies for communicating budget concerns effectively!

1: Prepare clear, data-driven budget reports

Preparing clear, data-driven budget reports is essential for communicating budget concerns effectively and ensuring everyone understands the financial landscape and can make informed decisions.

Actionable Steps:

- Use financial software to generate detailed reports with key metrics and trends for effective budget presentations.

- Train your team to interpret financial data through monthly training sessions, enhancing finance team leadership.

- Create a standardized template for budget reports to ensure consistency in fiscal responsibility communication.

Explanation:

These steps matter because they help create transparency and accuracy in financial reporting. By using software tools, you reduce errors and ensure that everyone is on the same page, improving financial transparency in management.

Training your team ensures they can act on the data, while a standardized template maintains consistency. For more on effective financial management and budget communication strategies, check out this guide from National University.

Key benefits of clear, data-driven reports include:

- Enhanced decision-making capabilities for cost-cutting discussions

- Improved financial transparency for stakeholder budget meetings

- Increased stakeholder confidence through budget forecasting techniques

Clear, data-driven reports enable better decision-making and proactive financial management, supporting effective communication of budget concerns and financial risk assessment reporting.

2: Schedule regular financial update meetings

Scheduling regular financial update meetings ensures that everyone is aligned and aware of the current financial landscape, which is crucial for communicating budget concerns effectively.

Actionable Steps:

- Establish a recurring monthly financial review meeting with key stakeholders. Set a specific date and time, such as the first Monday of each month, to discuss budget communication strategies.

- Use these meetings to review past performance, discuss current challenges, and explore future opportunities. Allocate specific time slots for each topic to ensure comprehensive coverage and promote financial transparency in management.

- Invite external experts occasionally to provide fresh insights and advice, scheduling a guest speaker quarterly to keep the discussions dynamic and informative, enhancing effective budget presentations.

Explanation:

These steps matter because they foster transparency and encourage proactive decision-making. Regular stakeholder budget meetings keep everyone informed and engaged, which is crucial for addressing financial challenges promptly and communicating budget concerns effectively.

Additionally, expert insights can provide valuable perspectives on fiscal responsibility communication. For more on the importance of regular updates, check out this resource.

These regular meetings create a culture of accountability and continuous improvement, ensuring all stakeholders are well-informed and ready to act on budget forecasting techniques and financial risk assessment reporting.

Let’s move on to the next step: using visuals to illustrate cash flow projections.

3: Use visuals to illustrate cash flow projections

Visuals make financial data more understandable, ensuring everyone grasps the key points quickly when communicating budget concerns effectively.

Actionable Steps:

- Incorporate charts and graphs into financial reports to highlight key data points for effective budget presentations.

- Use software like Excel or Tableau to create visuals.

- Ensure at least three visuals are included in each report.

- Develop infographic summaries of financial health for quick reference, enhancing financial transparency in management.

- Create a one-page infographic for each quarterly report.

- Distribute infographics to all stakeholders and request feedback.

Explanation:

These steps matter because visuals can simplify complex data, making it easier for stakeholders to understand financial trends and projections, which is crucial for communicating budget concerns effectively.

By using charts and infographics, you enhance clarity and engagement during financial discussions and stakeholder budget meetings. This approach aligns with industry best practices in financial communication and budget forecasting techniques.

For more insights, visit this resource on corporate budget planning.

Effective visual elements to consider for communicating budget concerns effectively:

- Line graphs for trend analysis in budget communication strategies

- Pie charts for budget allocation in cost-cutting discussions

- Bar charts for performance comparisons in financial risk assessment reporting

This method ensures your finance team leadership can make informed decisions based on clear and easily digestible financial data, promoting fiscal responsibility communication and facilitating executive-level budget negotiations.

Partner with Alleo for Effective Budget Communication

We’ve explored how to communicate budget concerns effectively as a finance manager. But did you know you can work directly with Alleo to make this journey of communicating budget concerns effectively easier and faster?

Set up an account with Alleo and create a personalized plan for budget communication strategies. Alleo’s AI coach provides affordable, tailored coaching support for effective budget presentations and financial transparency in management.

The coach will follow up on your progress in fiscal responsibility communication, handle changes in cost-cutting discussions, and keep you accountable via text and push notifications, enhancing your finance team leadership skills.

Ready to get started for free with stakeholder budget meetings and budget forecasting techniques?

Let me show you how to improve your financial risk assessment reporting and executive-level budget negotiations!

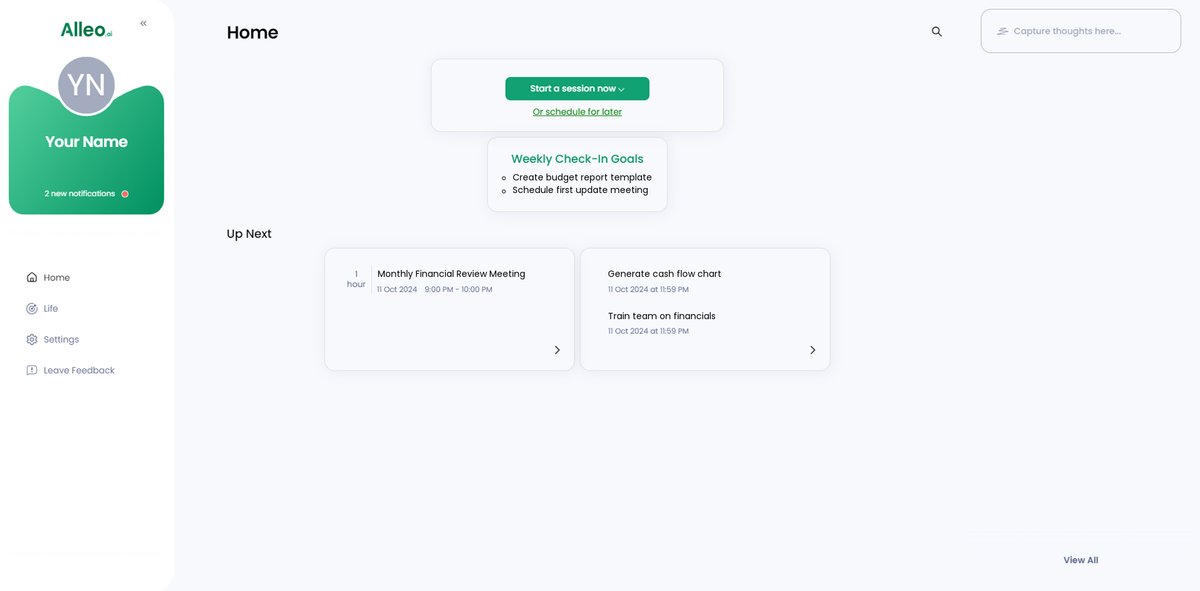

Step 1: Log In or Sign Up

To start improving your budget communication skills, log in to your Alleo account or create a new one if you haven’t already.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent financial practices that will help you effectively communicate budget concerns and maintain financial stability in your business.

Step 3: Select “Finances” as Your Focus Area

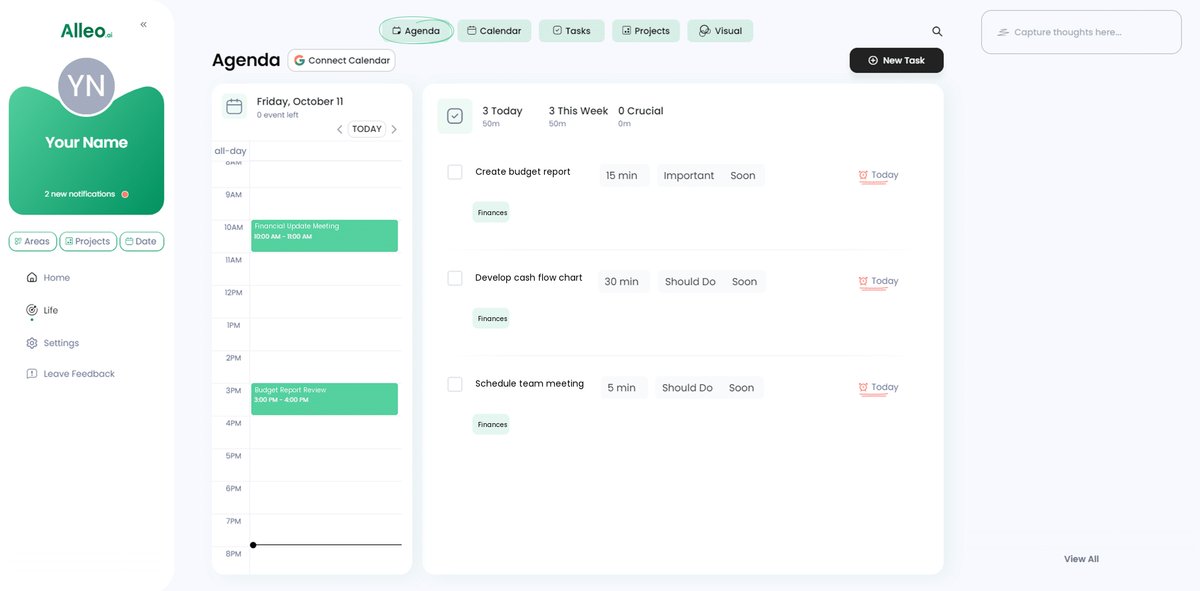

Choose “Finances” as your focus area in the Alleo AI coach to receive tailored guidance on improving your budget communication skills, aligning perfectly with the strategies discussed in this article for better financial management and stability.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your budget communication goals and set up a personalized plan to improve your financial stability.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on budget communication, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable to your budget communication strategies.

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to schedule your financial update meetings and track your progress in implementing effective budget communication strategies, ensuring you stay on top of your financial goals and deadlines.

Bringing It All Together for Financial Success

Let’s wrap this up.

Communicating budget concerns effectively is crucial for navigating financial challenges. By preparing clear, data-driven budget reports, scheduling regular financial update meetings, and using visuals to illustrate cash flow projections, you can ensure your business stays on course. These budget communication strategies enhance financial transparency in management.

Remember, you’re not alone in this journey. Many small business owners face similar challenges in fiscal responsibility communication.

You have the power to improve your financial stability with the right strategies, including effective budget presentations and cost-cutting discussions.

Take action today. Implement these steps and see the difference effective communication can make in finance team leadership and stakeholder budget meetings.

And don’t forget, Alleo is here to help. Sign up for free and let our AI coach guide you through the process of budget forecasting techniques and financial risk assessment reporting.

You’ve got this!