5 Essential Ways to Master Financial Management Concepts for Young Professionals

Ever felt overwhelmed by financial jargon and complex formulas? You’re not alone. Mastering financial management concepts can seem daunting, especially when it comes to personal finance basics and budgeting for beginners.

As a life coach, I’ve helped many young professionals and small business owners navigate these challenges. I often encounter common struggles with understanding and applying financial management concepts, from investment strategies for millennials to debt management techniques.

In this blog, you’ll discover actionable steps to master financial management concepts. You’ll learn practical strategies and tools to apply them effectively, including retirement planning for young adults, emergency fund importance, and financial goal setting.

Let’s dive in and explore how to start mastering financial management concepts that will set you up for long-term success.

Understanding the Challenges of Financial Management

Many clients initially struggle with the abstract nature of financial management. Mastering financial management concepts and personal finance basics can seem daunting without practical application.

This confusion often leads to poor financial decisions, affecting both personal and business finances, including budgeting for beginners and investment strategies for millennials.

For example, knowing the theory behind budgeting is one thing; implementing it is another. The lack of practical application makes it difficult to answer questions and apply knowledge effectively, especially in areas like debt management techniques and retirement planning for young adults.

In my experience, people often find themselves overwhelmed by the sheer volume of financial terms they need to learn. This complexity can make you hesitant to manage your finances proactively, from understanding credit scores to tax planning for early career professionals.

Ultimately, mastering financial management concepts requires not just understanding but applying concepts in real-world scenarios. Without this, achieving financial well-being remains a significant challenge, whether it’s establishing an emergency fund or work benefits maximization.

Essential Steps to Master Financial Management

Overcoming the challenge of mastering financial management concepts requires a few key steps. Here are the main areas to focus on to make progress in personal finance basics:

- Create a Personal Budget and Track Expenses: Set up a monthly budget and monitor your spending, essential for budgeting for beginners.

- Learn Key Financial Terms and Concepts Daily: Dedicate time each day to understand financial terminology, including investment strategies for millennials.

- Practice with Real-World Financial Scenarios: Use tools and simulations to apply what you’ve learned about debt management techniques and retirement planning for young adults.

- Automate Savings and Bill Payments: Set up automatic transfers and payments to streamline finances and build your emergency fund.

- Seek Mentorship from Experienced Professionals: Find a mentor to guide you through financial strategies, including financial goal setting and understanding credit scores.

Let’s dive in to mastering financial management concepts!

1: Create a personal budget and track expenses

Creating a personal budget and tracking expenses is crucial in mastering financial management concepts.

Actionable Steps:

- Set up a monthly budget using a simple spreadsheet or budgeting app, essential for personal finance basics.

- Track income and expenses weekly to ensure adherence, a key aspect of budgeting for beginners.

- Allocate funds for fixed and variable expenses, considering emergency fund importance.

- Categorize your expenses to identify spending patterns and aid in financial goal setting.

- Review and categorize all transactions at the end of each month to improve debt management techniques.

- Adjust budget categories as needed to align with financial goals and investment strategies for millennials.

Explanation:

These steps matter because they help you understand where your money goes and make informed financial decisions, crucial for mastering financial management concepts.

By identifying spending patterns, you can adjust your budget to meet your financial goals. According to budgeting basics, categorizing expenses is essential for better financial management.

Key benefits of budgeting include:

- Increased financial awareness, aiding in understanding credit scores

- Better control over spending, supporting tax planning for early career professionals

- Improved ability to save for goals, including retirement planning for young adults

Taking these initial steps will set a solid foundation for your financial journey and work benefits maximization.

2: Learn key financial terms and concepts daily

Understanding financial terms daily is crucial for mastering financial management concepts.

Actionable Steps:

- Dedicate 15 minutes each day to learning a new financial term related to personal finance basics.

- Measure: Keep a glossary of terms and review it weekly to reinforce investment strategies for millennials.

- Action: Use flashcards or a financial dictionary for daily learning of budgeting for beginners.

- Join a financial literacy group or forum focused on mastering financial management concepts.

- Measure: Participate in discussions and ask questions regularly about debt management techniques.

- Action: Share knowledge and learn from the experiences of others on retirement planning for young adults.

Explanation:

These steps matter because they help you build a solid foundation of financial knowledge, including understanding credit scores and the importance of an emergency fund. Being familiar with key terms allows you to make informed decisions in financial goal setting.

According to research, integrating real-life scenarios and consistent learning enhances financial literacy. This daily practice will make you confident in your financial management skills, including tax planning for early career professionals and work benefits maximization.

Moving on, let’s explore how to practice with real-world financial scenarios.

3: Practice with real-world financial scenarios

Practicing with real-world financial scenarios helps you apply theoretical knowledge and improve decision-making skills when mastering financial management concepts.

Actionable Steps:

- Simulate financial decisions using online tools and calculators to understand personal finance basics.

- Measure: Track the outcomes of different scenarios and compare results for effective budgeting for beginners.

- Action: Apply these simulations to your actual financial planning and investment strategies for millennials.

- Attend financial management workshops or webinars focusing on debt management techniques and retirement planning for young adults.

- Measure: Implement at least two strategies learned from each session, including emergency fund importance.

- Action: Network with other attendees for support and advice on financial goal setting.

Explanation:

These steps matter because they bridge the gap between theory and practice in mastering financial management concepts. They provide a safe environment to test and refine your skills, including understanding credit scores and tax planning for early career professionals.

According to research, using interactive tools and real-life scenarios enhances financial literacy. This hands-on approach will make you more confident in managing your finances and work benefits maximization.

Moving on, let’s explore how automating your savings and bill payments can streamline your financial management.

4: Automate savings and bill payments

Automating your savings and bill payments is crucial to streamline financial management and avoid late fees, an essential step in mastering financial management concepts.

Actionable Steps:

- Set up automatic transfers to your savings account.

- Measure: Ensure a fixed percentage of income is saved each month, supporting personal finance basics.

- Action: Use your bank’s auto-transfer feature to streamline savings and build your emergency fund.

- Automate bill payments to avoid late fees.

- Measure: Monitor your account to ensure payments are processed timely, aiding in debt management techniques.

- Action: Use online banking to schedule payments for regular bills, a key aspect of budgeting for beginners.

Explanation:

These steps matter because they help you stay consistent with your savings and ensure bills are paid on time, crucial for mastering financial management concepts.

According to budgeting experts, automating finances can significantly reduce stress and improve financial stability.

By setting up automatic transfers and payments, you can focus on other financial goals with peace of mind, such as investment strategies for millennials or retirement planning for young adults.

Advantages of automation in financial management:

- Consistent savings habits

- Reduced risk of missed payments

- More time for strategic financial planning and financial goal setting

Next, let’s explore how seeking mentorship from experienced professionals can further enhance your financial management skills and understanding of work benefits maximization.

5: Seek mentorship from experienced professionals

Finding a mentor can significantly enhance your skills in mastering financial management concepts, providing you with valuable insights and guidance on personal finance basics and beyond.

Actionable Steps:

- Connect with a financial mentor through professional networks.

- Measure: Schedule monthly meetings to discuss strategies and challenges in budgeting for beginners and investment strategies for millennials.

- Action: Set specific learning goals and seek feedback on your progress in mastering financial management concepts.

- Join industry-specific financial advisory groups.

- Measure: Attend at least one meeting per month and actively participate in discussions on debt management techniques and retirement planning for young adults.

- Action: Utilize group resources and advice for real-world applications of financial goal setting and understanding credit scores.

Explanation:

These steps matter because they offer personalized advice and support. By connecting with a mentor and joining advisory groups, you gain practical knowledge and experience in mastering financial management concepts.

According to NEFE, collaboration and mentorship are crucial for effective financial education. This support network will help you navigate complex financial decisions confidently, including tax planning for early career professionals and work benefits maximization.

Key traits to look for in a financial mentor:

- Extensive experience in your area of interest, such as emergency fund importance

- Willingness to share knowledge openly about personal finance basics

- Strong communication skills to help you in mastering financial management concepts

With mentorship in place, you’ll be better prepared to manage your finances and achieve your goals in mastering financial management concepts.

Partner with Alleo on Your Financial Mastery Journey

We’ve explored the challenges of mastering financial management concepts and how solving them can benefit your career. But did you know you can work directly with Alleo to make this journey easier and faster?

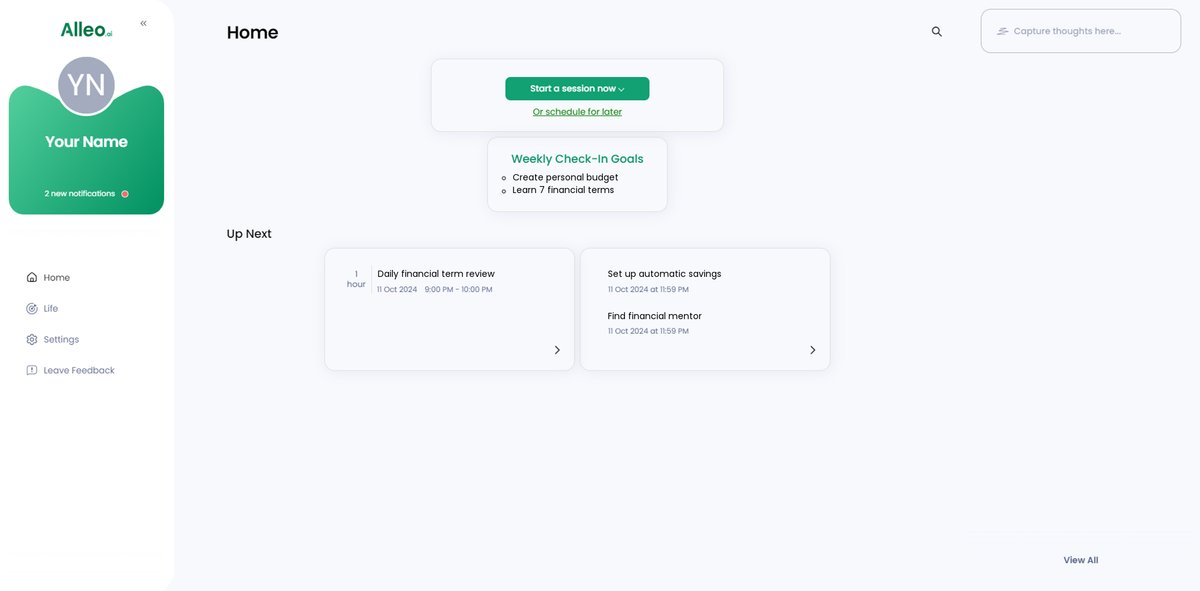

Alleo offers an AI coach that provides tailored coaching support for mastering financial management concepts, including personal finance basics and budgeting for beginners. Setting up an account is simple.

Start by creating a personalized plan and work with your coach to tackle specific challenges like investment strategies for millennials and debt management techniques. The coach follows up on your progress, handles changes, and keeps you accountable via text and push notifications, helping you with financial goal setting.

Ready to get started for free and begin understanding credit scores and tax planning for early career professionals?

Let me show you how!

Step 1: Log In or Create Your Account

To begin your financial mastery journey with Alleo’s AI coach, Log in to your account or create a new one to access personalized coaching and start building your financial management skills.

Step 2: Choose Your Financial Management Focus

Click on “Building better habits and routines” to start mastering financial management concepts through consistent, practical actions that align with the article’s strategies for budgeting, learning, and applying financial knowledge in your daily life.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in the AI coach to align with your goal of mastering financial management concepts and receive tailored guidance on budgeting, financial terms, and practical scenarios to enhance your financial literacy and decision-making skills.

Step 4: Starting a coaching session

Begin your financial mastery journey by scheduling an intake session with your AI coach to establish your personalized plan and set clear objectives for improving your financial management skills.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable in your journey to financial mastery.

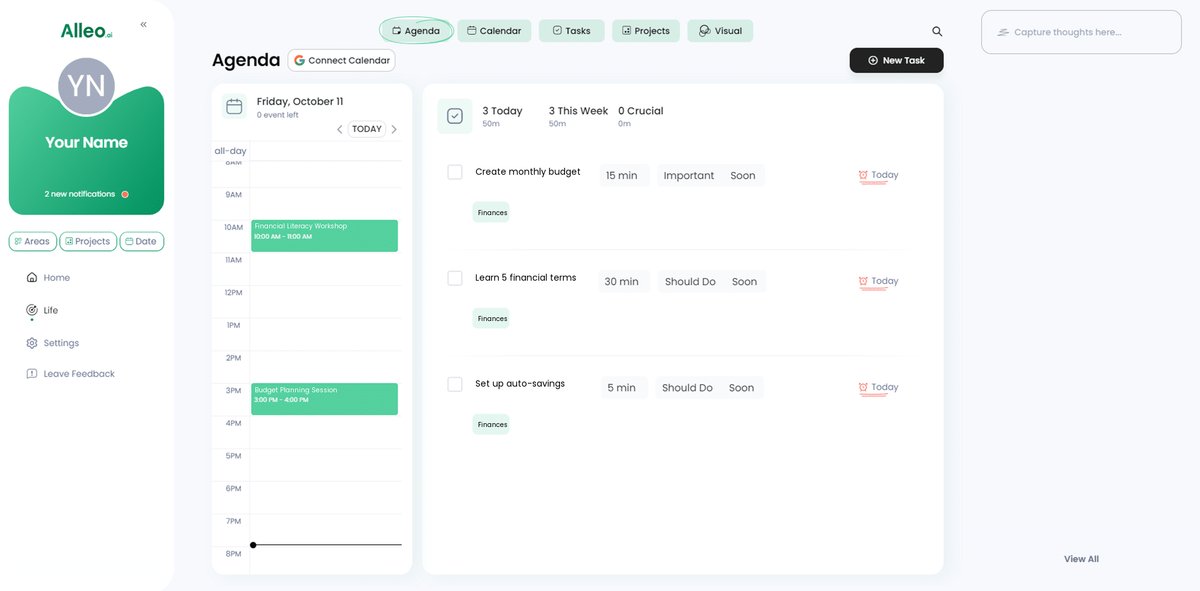

6: Adding events to your calendar or app

Use the Alleo AI coach’s calendar and task features to schedule and track your financial management activities, helping you stay organized and accountable as you work towards mastering key concepts and applying them in real-world scenarios.

Wrapping Up Your Financial Mastery Journey

You’ve learned how to tackle mastering financial management concepts head-on.

Creating a personal budget, a key aspect of personal finance basics, helps you track where your money goes.

Learning key financial terms daily builds your confidence in understanding credit scores and investment strategies for millennials.

Practicing with real-world scenarios bridges the gap between theory and reality, especially in budgeting for beginners.

Automating savings and bill payments keeps you on track effortlessly, supporting your financial goal setting.

And seeking mentorship from experienced professionals provides invaluable guidance on debt management techniques and retirement planning for young adults.

Mastering financial management concepts isn’t easy, but it’s doable with proper tax planning for early career professionals.

Remember, you’re not alone in this journey of understanding the emergency fund importance.

With Alleo’s AI coach, you’re one step closer to financial mastery and work benefits maximization.

Take that first step today and start your journey with Alleo for free.

Your financial future awaits!