How to Manage $50,000 Investments Without High Fees: A Young Professional’s Comprehensive Guide

Are you a young professional or small business owner looking for affordable $50,000 investment management without paying high fees?

Many people spend over $1,000 annually on financial management firms for services they could handle themselves with the right knowledge and tools. Low-cost investment strategies and DIY portfolio management can be game-changers.

As a life coach, I’ve guided numerous clients through these financial challenges, helping them explore passive investing techniques and tax-efficient investment options.

In this article, you’ll learn cost-effective strategies like investing in low-cost ETFs and index funds for young investors, using a Roth IRA, and leveraging robo-advisors for beginners.

Let’s dive into affordable $50,000 investment management strategies.

Why High Fees Are a Big Issue

Let’s get straight to the point: paying $1,000 or more annually to financial management firms for a $50,000 investment is tough to justify. Many clients initially struggle with understanding if the value they receive matches these high fees, especially when seeking affordable $50,000 investment management options.

The truth is, often, it doesn’t.

In my experience, people often find the investment mixes provided by these firms are not always tailored to their specific needs. This can lead to suboptimal returns, which is why many turn to low-cost investment strategies.

You deserve better.

High fees eat into your returns, which can be painful over time. Imagine the difference that extra money could make if it were reinvested instead using passive investing techniques or tax-efficient investment options.

Cost-effective solutions are not just a preference; they’re a necessity for long-term wealth building strategies.

Let’s explore smarter ways to manage your investments, such as DIY portfolio management or using robo-advisors for beginners.

Key Strategies for Managing $50,000 Investments Without High Fees

Overcoming this challenge requires a few key steps for affordable $50,000 investment management. Here are the main areas to focus on to make progress with low-cost investment strategies.

- Invest in low-cost index ETFs like VOO: Research and invest in top-performing, low-cost ETFs for passive investing techniques.

- Open a Roth IRA for tax-free growth: Utilize the tax benefits of a Roth IRA for your investments, a tax-efficient investment option.

- Use a robo-advisor for automated management: Leverage automated platforms like robo-advisors for beginners for efficient investment management.

- Diversify with low-fee mutual funds: Spread your investment across various low-fee mutual funds, ideal for index funds for young investors.

- Rebalance portfolio annually to maintain goals: Regularly adjust your portfolio to stay on track with your long-term wealth building strategies.

Let’s dive in to explore these affordable $50,000 investment management techniques!

1: Invest in low-cost index ETFs like VOO

Investing in low-cost index ETFs like VOO can be a game-changer for affordable $50,000 investment management, offering efficient passive investing techniques.

Actionable Steps:

- Research top-performing low-cost ETFs: Set aside an hour each week to research ETFs like VOO. Use financial news websites and ETF comparison tools to evaluate their performance and fees, focusing on index funds for young investors.

- Open a brokerage account: Choose a reputable brokerage firm with low or no trading fees. Complete the account opening process online with the necessary documentation, considering commission-free trading platforms.

- Automate monthly investments: Set up automatic monthly investments into your chosen ETFs. This helps you take advantage of dollar-cost averaging methods and stay consistent with your contributions for long-term wealth building strategies.

Explanation:

These steps matter because they ensure cost-effective investing while maximizing potential returns. By automating investments and choosing low-fee options, you can avoid high management fees and implement DIY portfolio management techniques.

According to Investopedia, investing in low-cost index funds is a proven strategy for long-term growth.

Key benefits of low-cost index ETFs include:

- Lower fees compared to actively managed funds, supporting affordable $50,000 investment management

- Broad market exposure, ideal for asset allocation for millennials

- Potential for steady, long-term growth through tax-efficient investment options

This method not only saves you money but also aligns with current trends in passive investing and low-cost investment strategies.

2: Open a Roth IRA for tax-free growth

Opening a Roth IRA can significantly enhance your affordable $50,000 investment management strategy by offering tax-free growth and withdrawals, making it an excellent tax-efficient investment option.

Actionable Steps:

- Research and understand Roth IRA benefits: Learn about the tax advantages and withdrawal rules for this long-term wealth building strategy. Ensure you meet eligibility criteria by visiting resources like Investopedia.

- Choose a financial institution: Compare banks and brokerage firms for the best Roth IRA options. Look for low fees and a variety of investment choices, including index funds for young investors.

- Maximize contributions: Aim to contribute the maximum annual limit ($7,000 for 2024 and 2025) as part of your affordable $50,000 investment management plan. Set up automatic transfers from your bank to your Roth IRA, implementing dollar-cost averaging methods.

Explanation:

These steps are crucial because they help you leverage the tax benefits and diverse investment options of a Roth IRA. By maximizing contributions and automating transfers, you can ensure consistent growth in your low-cost investment strategy.

According to Investopedia, Roth IRAs are ideal for long-term wealth building due to their tax-free growth potential, making them an essential component of affordable $50,000 investment management.

This method aligns with current trends in retirement planning and passive investing techniques. Next, we’ll explore the benefits of using a robo-advisor for automated management.

3: Use a robo-advisor for automated management

Utilizing a robo-advisor helps automate your investments, making it easier to manage your $50,000 efficiently. This method offers affordable $50,000 investment management for those seeking low-cost investment strategies.

Actionable Steps:

- Evaluate different robo-advisor platforms: Compare platforms based on fees, investment strategies, and user reviews. Choose one that fits your financial goals and risk tolerance. Many robo-advisors are ideal for beginners and offer passive investing techniques.

- Set up and customize your account: Complete the onboarding process, including risk assessment and goal setting. Customize your portfolio based on preferences and objectives, considering tax-efficient investment options.

- Regularly monitor performance: Use the robo-advisor dashboard to review your account performance. Make necessary adjustments to stay aligned with your financial goals, such as implementing dollar-cost averaging methods.

Explanation:

These steps are crucial because they automate investment management, saving you time and effort while ensuring your portfolio remains aligned with your long-term wealth building strategies.

According to NerdWallet, robo-advisors offer a cost-effective way to manage investments, with some platforms charging no management fees. This method benefits those looking for efficient, affordable $50,000 investment management.

Using a robo-advisor can simplify your investment strategy, making it easier to focus on other financial goals while maintaining proper asset allocation for millennials and young investors.

4: Diversify with low-fee mutual funds

Diversifying with low-fee mutual funds is crucial for balancing risk and optimizing returns, especially when considering affordable $50,000 investment management strategies.

Actionable Steps:

- Identify suitable mutual funds: Research low-fee mutual funds that offer diversification across various asset classes. Consider index funds for young investors, such as Vanguard’s index mutual funds, for their low expense ratios.

- Allocate investments: Decide on an asset allocation for millennials that aligns with your risk tolerance and investment horizon. Invest in a mix of equity, bond, and international mutual funds using passive investing techniques.

- Regularly review and adjust: Periodically review the performance of your mutual funds. Reallocate as needed to maintain your desired asset mix and minimize risk, employing dollar-cost averaging methods.

Explanation:

These steps matter because they ensure your investments are well-diversified and cost-effective. By selecting low-fee mutual funds and maintaining a balanced portfolio, you can maximize returns while minimizing risk in your affordable $50,000 investment management approach.

According to Investopedia, diversifying with low-fee mutual funds is a smart strategy for long-term wealth building strategies.

When choosing mutual funds, consider these factors:

- Expense ratio and management fees

- Historical performance and consistency

- Fund manager’s track record

This approach aligns with current trends in low-cost investment strategies and DIY portfolio management. Now, let’s explore how rebalancing your portfolio annually can help maintain your investment goals.

5: Rebalance portfolio annually to maintain goals

Rebalancing your portfolio annually is crucial to ensure it aligns with your financial goals and risk tolerance, especially when practicing affordable $50,000 investment management.

Actionable Steps:

- Set a rebalancing schedule: Choose a specific date each year to review your portfolio. Mark this date on your calendar and set reminders for your DIY portfolio management.

- Assess your current portfolio allocation: Compare your current asset allocation against your target allocation. Identify any significant deviations that need correction, considering asset allocation for millennials.

- Make necessary adjustments: Sell overperforming assets and buy underperforming ones to restore balance. Consider tax implications and transaction costs, utilizing tax-efficient investment options.

Explanation:

These steps matter because they help maintain your investment strategy’s effectiveness and reduce risk. Regular rebalancing aligns your portfolio with your long-term wealth building strategies.

According to Investopedia, rebalancing ensures your investments remain diversified and aligned with your risk tolerance.

By following this method, you can keep your investments on track and optimize returns, even with affordable $50,000 investment management approaches.

Partner with Alleo for Smart Investment Management

We’ve explored cost-effective strategies to manage your $50,000 investments efficiently. But did you know you can work directly with Alleo for affordable $50,000 investment management that makes this journey easier and faster?

Set up an account with Alleo in minutes. Create a personalized investment plan tailored to your goals, incorporating passive investing techniques and tax-efficient investment options.

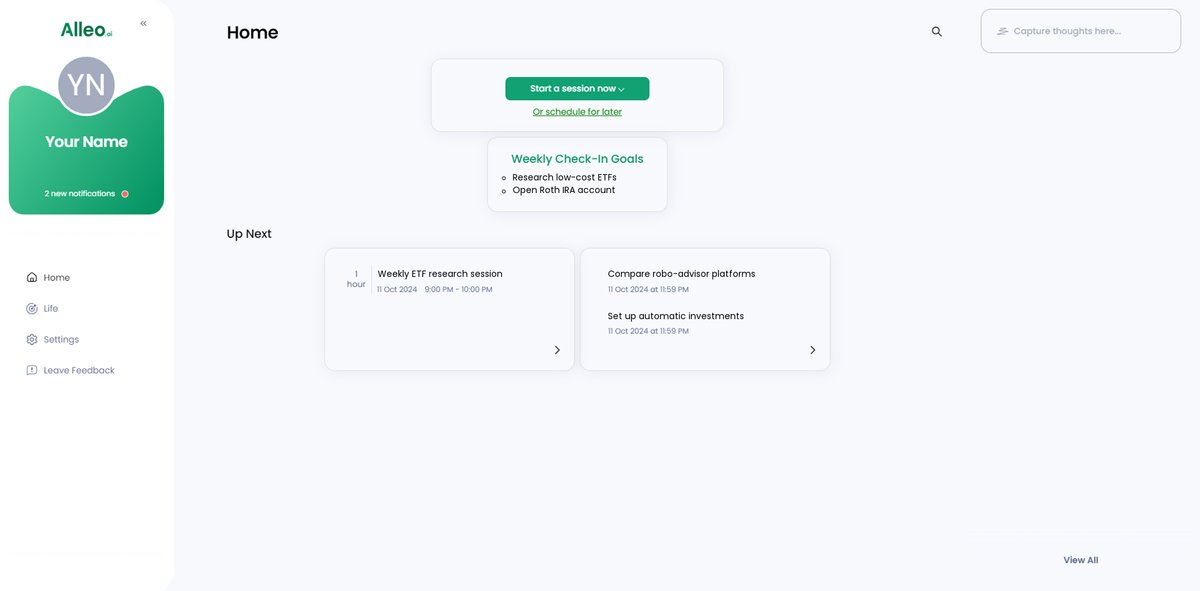

Alleo’s AI coach provides affordable, tailored coaching support just like a human advisor. You’ll get full coaching sessions on topics like index funds for young investors and asset allocation for millennials, plus a free 14-day trial, no credit card required.

Alleo’s coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you implement long-term wealth building strategies.

Ready to get started for free with affordable $50,000 investment management? Let me show you how!

Step 1: Log In or Create Your Account

Log in to your existing Alleo account or create a new one to start managing your $50,000 investment portfolio with personalized AI coaching support.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a consistent approach to managing your investments, which is crucial for achieving your financial goals without relying on high-fee management firms.

Step 3: Select “Finances” as Your Focus Area

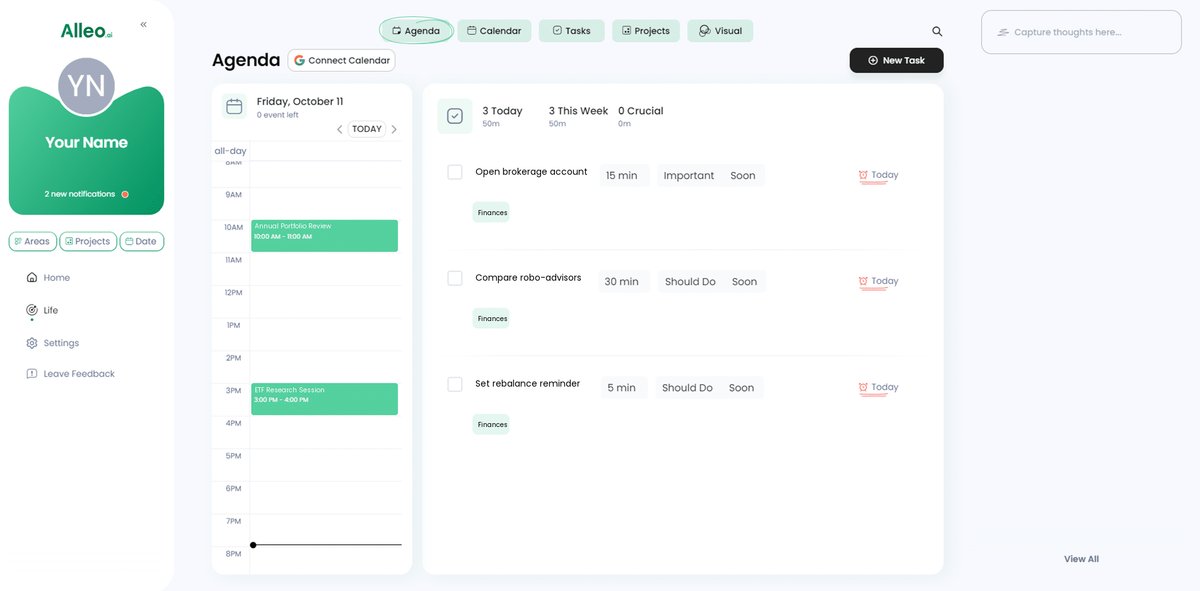

Choose “Finances” as your focus area to get personalized guidance on managing your $50,000 investment effectively, aligning with the strategies discussed in this article for maximizing returns without high fees.

Step 4: Starting a coaching session

Begin your journey with Alleo by participating in an intake session, where you’ll discuss your financial goals and create a personalized investment plan to manage your $50,000 efficiently without high fees.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the investment goals you discussed, allowing you to track your progress and stay aligned with your financial strategy.

6: Add Investment Events to Your Calendar

Use Alleo’s calendar and task features to schedule and track important investment activities like rebalancing dates, contribution deadlines, and performance reviews, helping you stay on top of your financial goals and monitor your progress in solving investment management challenges.

Take Control of Your Investments

You’re now equipped with the tools to manage your $50,000 investments without high fees. You’ve learned about affordable $50,000 investment management strategies using low-cost ETFs, Roth IRAs, robo-advisors for beginners, mutual funds, and rebalancing techniques for passive investing.

These low-cost investment strategies will help you achieve your financial goals more efficiently. Remember, every dollar saved on fees is a dollar that can be reinvested, supporting long-term wealth building strategies.

You can do this.

Managing your investments doesn’t have to be overwhelming. With the right knowledge and tools, you can take control of your financial future through DIY portfolio management and tax-efficient investment options.

If you need extra support, Alleo is here to help. You can start for free and get personalized investment coaching, including guidance on asset allocation for millennials and dollar-cost averaging methods.

Let’s make your financial journey easier and more rewarding together, using affordable $50,000 investment management techniques.