7 Powerful Steps for CEOs to Rebuild Investor Confidence After a Major Stock Decline

What if you could turn around a significant stock decline and rebuild investor confidence quickly? Rebuilding investor confidence after decline is crucial for long-term value creation and stock market recovery.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, addressing both investor trust and company morale is crucial for effective crisis management for public companies.

In this article, you’ll learn strategies to enhance transparency, manage crises effectively, and leverage AI for better financial forecasting. We’ll explore corporate communication during financial crisis, restoring shareholder trust, and investor relations best practices.

Let’s dive into CEO leadership in market downturns and financial transparency measures that can aid in rebuilding stock price after crash.

Understanding the Depth of the Problem

When your stock value plummets, it doesn’t just hurt your financials. It shakes investor confidence and morale within your company, necessitating a focus on rebuilding investor confidence after decline.

This situation is especially tough for startup founders facing stock market recovery strategies.

Many clients initially struggle with the fear of investors pulling out. This fear is valid in the context of restoring shareholder trust.

Investors often react quickly to avoid further losses, highlighting the importance of investor relations best practices.

The urgency to address the decline is paramount. Without a clear recovery strategy, the situation can worsen, emphasizing the need for financial transparency measures.

I often see companies lose key stakeholders during these critical times, underlining the importance of CEO leadership in market downturns.

You need to act swiftly. Rebuilding investor confidence after decline requires a focused approach and clear corporate communication during financial crisis.

Let’s tackle this challenge together, focusing on long-term value creation plans.

Overcoming Investor Confidence Challenges

To tackle the problem of rebuilding investor confidence after decline effectively, focus on these key actions:

- Enhance transparency through regular updates: Schedule consistent updates to keep investors informed, adhering to investor relations best practices.

- Implement clear crisis management strategy: Prepare a robust plan for handling crises, essential for corporate communication during financial crisis.

- Focus on core business strengths: Prioritize and enhance top-performing products or services to support long-term value creation plans.

- Conduct comprehensive risk assessment: Identify and mitigate potential risks, crucial for stock market recovery strategies.

- Engage in strategic investor communication: Foster open dialogue with investors to aid in restoring shareholder trust.

- Develop a robust turnaround plan: Create a detailed plan with clear milestones, demonstrating CEO leadership in market downturns.

- Leverage AI for improved financial forecasting: Use AI tools for accurate financial predictions and earnings guidance and forecasting techniques.

Let’s dive in to explore these strategies for rebuilding investor confidence after decline!

1: Enhance transparency through regular updates

Maintaining transparency is vital to rebuilding investor confidence after decline and restoring shareholder trust.

Actionable Steps:

- Schedule bi-weekly investor calls to provide updates and answer questions, a key investor relations best practice.

- Publish monthly performance reports highlighting key metrics and progress, enhancing financial transparency measures.

- Create a transparent dashboard for investors to track company performance in real-time, supporting stock market recovery strategies.

Explanation: Regular updates keep investors informed and reassured about your company’s progress. This approach helps build trust and shows your commitment to transparency, crucial for rebuilding investor confidence after decline.

Moreover, according to PR News Online, maintaining transparency and accountability is essential for rebuilding trust, particularly during corporate communication during financial crisis.

Key benefits of enhancing transparency include:

- Improved investor trust and loyalty

- Reduced speculation and misinformation

- Enhanced company reputation, supporting long-term value creation plans

These steps will lead to a more informed and confident investor base, helping to stabilize your company’s stock value and contributing to rebuilding stock price after crash.

2: Implement clear crisis management strategy

Having a clear crisis management strategy is essential to navigating the turbulence of a significant stock decline and rebuilding investor confidence after decline.

Actionable Steps:

- Develop a crisis response team with defined roles and responsibilities for stock market recovery strategies.

- Conduct regular crisis simulation drills to ensure preparedness for market downturns.

- Establish a communication protocol for timely updates during crises, focusing on corporate communication during financial crisis.

Explanation: Implementing a structured crisis management strategy helps your team respond effectively to challenges, maintaining investor confidence and restoring shareholder trust.

According to Aswath Damodaran, regularly revisiting strategic assumptions is crucial in adapting to changing environments. This approach ensures that your company remains resilient and demonstrates proactive leadership in rebuilding investor confidence after decline.

Taking these steps will help stabilize your company during turbulent times and reassure your investors about your preparedness and commitment to overcoming challenges, ultimately contributing to long-term value creation plans.

3: Focus on core business strengths

Focusing on core business strengths is crucial to stabilize your company during a significant stock decline and rebuild investor confidence after decline.

Actionable Steps:

- Identify and prioritize top-performing products or services. Conduct an analysis to determine which offerings generate the most revenue and customer satisfaction, aiding in stock market recovery strategies.

- Allocate resources effectively. Redirect funds and personnel to enhance these strengths, ensuring they remain competitive in the market and support long-term value creation plans.

- Discontinue non-core business units. Streamline operations by divesting or shutting down underperforming segments, demonstrating crisis management for public companies.

Explanation: Prioritizing core strengths helps your company maintain a competitive edge and ensures efficient use of resources, which is essential for rebuilding investor confidence after decline.

This focused approach demonstrates to investors that you are committed to sustainable growth and restoring shareholder trust.

According to Aswath Damodaran, companies that regularly revisit and refine their strategic assumptions are better positioned to thrive in a changing environment, showcasing effective CEO leadership in market downturns.

Taking these steps will help you build a resilient foundation, instilling confidence in your investors and stakeholders, and supporting efforts in rebuilding stock price after crash.

4: Conduct comprehensive risk assessment

Performing a comprehensive risk assessment is crucial for identifying potential threats and mitigating them effectively, especially when rebuilding investor confidence after decline.

Actionable Steps:

- Perform a thorough risk analysis: Identify all possible vulnerabilities, including financial, operational, and market risks, as part of stock market recovery strategies.

- Develop mitigation plans: Create specific strategies to address each identified risk, ensuring readiness for any scenario and demonstrating crisis management for public companies.

- Regularly review and update: Continuously monitor and revise the risk management plan to adapt to new challenges, a key aspect of investor relations best practices.

Explanation: Conducting a detailed risk assessment helps you anticipate and prepare for potential problems, maintaining investor confidence and restoring shareholder trust.

According to EY, regularly revisiting strategic assumptions is vital for adapting to changing environments. This proactive approach reassures investors of your commitment to stability and resilience, crucial for rebuilding investor confidence after decline.

Key areas to focus on in your risk assessment:

- Market volatility and economic uncertainties

- Regulatory changes and compliance issues

- Technological disruptions and cybersecurity threats

By following these steps, you’ll build a robust foundation, ready to face any challenges head-on and implement long-term value creation plans.

5: Engage in strategic investor communication

Engaging in strategic investor communication is crucial for rebuilding investor confidence after decline and maintaining trust after a major stock decline.

Actionable Steps:

- Host quarterly investor town halls: Foster open dialogue and address concerns directly to build rapport, a key aspect of investor relations best practices.

- Send personalized emails to key investors: Provide tailored updates to keep them informed and reassured, enhancing financial transparency measures.

- Use social media platforms: Share positive news and developments to maintain a positive public image, supporting stock market recovery strategies.

Explanation: Effective communication helps keep investors informed and reassured about your company’s direction, essential for restoring shareholder trust.

According to PR News Online, transparency and accountability are key to rebuilding trust. This approach ensures investors feel valued and involved, supporting their confidence in your leadership during market downturns.

By fostering open communication, you can stabilize investor sentiment and pave the way for recovery, crucial for rebuilding investor confidence after decline.

6: Develop a robust turnaround plan

Developing a robust turnaround plan is essential to stabilize your company and regain investor confidence after decline.

Actionable Steps:

- Create a detailed turnaround plan: Outline clear milestones, timelines, and responsibilities for each aspect of the recovery process, focusing on long-term value creation plans.

- Secure buy-in from key stakeholders: Engage with stakeholders to ensure their support and commitment to the turnaround strategy, emphasizing investor relations best practices.

- Monitor progress regularly: Track the implementation and make adjustments as needed to stay on course, utilizing financial transparency measures.

Explanation: A well-structured turnaround plan demonstrates your commitment to recovery and provides a roadmap for success in rebuilding investor confidence after decline.

This proactive approach reassures investors about your company’s future and aids in stock market recovery strategies.

According to PwC, businesses with solid turnaround plans are better positioned to navigate challenges and capitalize on opportunities, which is crucial for restoring shareholder trust.

By following these steps, you’ll instill confidence in your investors and pave the way for sustainable growth, effectively rebuilding investor confidence after decline.

7: Leverage AI for improved financial forecasting

Leveraging AI for improved financial forecasting is crucial in rebuilding investor confidence after a major stock decline. This approach is key to stock market recovery strategies and restoring shareholder trust.

Actionable Steps:

- Implement AI tools: Use AI to analyze financial data and predict future trends. This helps in making informed decisions based on accurate forecasts, enhancing investor relations best practices.

- Regularly update models: Continuously update forecasting models with new data to reflect current market conditions and improve accuracy, a vital part of rebuilding stock price after crash.

- Use AI-driven insights: Integrate AI insights into strategic planning to optimize financial performance and stability, demonstrating CEO leadership in market downturns.

Explanation: Implementing these steps ensures your financial forecasts are accurate and reliable, helping to restore investor confidence and support long-term value creation plans.

According to EY, regularly revisiting strategic assumptions is vital for adapting to changing environments. This proactive approach reassures investors of your commitment to stability and resilience, crucial for rebuilding investor confidence after decline.

Key benefits of AI-powered financial forecasting:

- Enhanced accuracy in predicting market trends

- Faster decision-making based on real-time data analysis

- Improved risk management through advanced pattern recognition

By leveraging AI, you can better navigate financial uncertainties and demonstrate strong leadership to your investors, enhancing corporate communication during financial crisis and implementing effective financial transparency measures.

Partner with Alleo to Rebuild Investor Confidence

We’ve explored strategies for rebuilding investor confidence after a major stock decline. Did you know you can work directly with Alleo to make this journey of stock market recovery easier and faster?

Alleo provides tailored coaching support, just like a human coach, to assist in restoring shareholder trust. Here’s how:

- Set Up an Account: Sign up for a free 14-day trial—no credit card needed. Alleo will help you create a personalized plan for rebuilding investor confidence after decline.

- Personalized Coaching: Work with Alleo’s AI coach on investor relations best practices like transparency, crisis management for public companies, and financial forecasting techniques. Alleo will follow up on your progress, handle changes, and keep you accountable via text and push notifications.

- Track and Adjust: Use Alleo’s tools to monitor your progress and adjust your strategy for rebuilding stock price after crash as needed.

Ready to get started for free? Let me show you how to implement these corporate communication strategies during financial crisis!

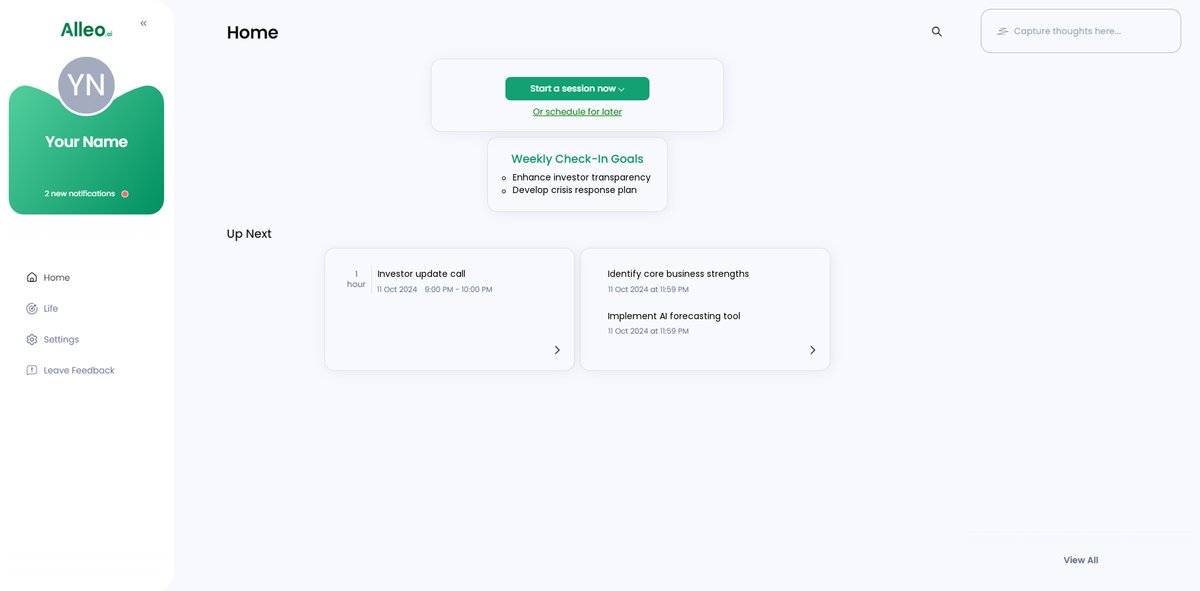

Step 1: Log In or Create Your Account

To begin rebuilding investor confidence with Alleo’s AI coach, log in to your existing account or create a new one to access personalized guidance and support.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to address the challenges of rebuilding investor confidence and company performance, aligning your personal growth with your organization’s recovery strategy.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on rebuilding investor confidence, improving financial forecasting, and developing effective strategies to stabilize your company’s stock value after a significant decline.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your investor confidence challenges and outline a personalized plan to rebuild trust and stabilize your company’s stock value.

Step 5: Viewing and managing goals after the session

After your coaching session on rebuilding investor confidence, check the app’s home page to review and manage the goals you discussed, allowing you to track your progress in implementing strategies like enhancing transparency and developing a turnaround plan.

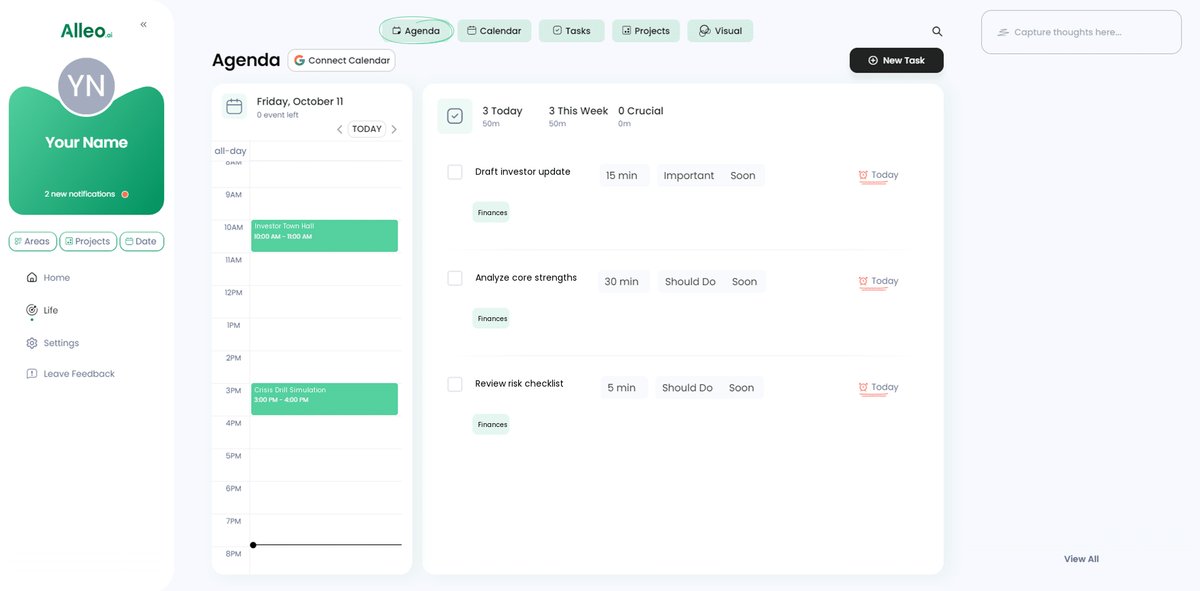

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important events like investor updates, crisis management drills, and financial forecasting sessions, helping you stay on top of your investor confidence rebuilding efforts.

Moving Forward with Confidence

You’re now equipped with strategies for rebuilding investor confidence after a major stock decline.

Remember, transparency is key in restoring shareholder trust. Keep your investors informed with regular updates as part of your investor relations best practices.

Effective crisis management for public companies is crucial. Prepare for any scenario.

Focus on your core strengths. Allocate resources wisely to top-performing products as part of your long-term value creation plans.

Conduct thorough risk assessments. Identify and address vulnerabilities to support stock market recovery strategies.

Communicate strategically with investors. Foster open dialogue and build trust through corporate communication during financial crisis.

Develop a robust turnaround plan. Show investors your commitment to rebuilding investor confidence after decline.

Leverage AI for financial forecasting. Make informed decisions based on accurate data to support earnings guidance and forecasting techniques.

You can do this. Alleo is here to help with CEO leadership in market downturns.

Sign up for a free 14-day trial and start implementing financial transparency measures today.