7 Proven Strategies to Tailor Your Investor Relations for Different Stakeholders

Have you ever wondered how to tailor your investor relations strategies to meet the unique needs of every stakeholder?

Managing relationships with various types of investors, from individual retail investors to large institutional funds, can be challenging. Each group has different information needs and communication styles, requiring customized IR presentations and tailored IR messaging.

As a life coach, I’ve helped many professionals navigate these challenges in stakeholder engagement in finance. I’ve seen firsthand the impact of personalized investor relations and effective shareholder relationship management.

In this article, you’ll learn actionable strategies to tailor your investor communications effectively. We’ll cover segmenting investors, developing targeted messaging, and more, including investor communication techniques and corporate disclosure strategies.

Let’s dive into tailoring investor relations strategies.

Understanding the Complexity of Investor Relationships

Managing relationships with different types of investors is no small feat. Tailoring investor relations strategies is crucial as retail investors often seek straightforward, relatable information, while institutional funds demand detailed, data-driven insights.

Failure to address these needs can lead to frustration and disengagement. This disconnect can result in missed opportunities and damaged trust, highlighting the importance of effective stakeholder engagement in finance.

I frequently observe clients struggle with balancing these demands. They often feel overwhelmed by the diverse expectations, underscoring the need for customizing IR presentations.

Imagine consistently meeting everyone’s needs through tailored IR messaging for the analyst community. It’s challenging but crucial for successful shareholder relationship management.

These complexities highlight why a tailored approach is essential in investor communication techniques. Let’s explore solutions together to enhance corporate disclosure strategies and financial transparency best practices.

Key Steps to Tailor Investor Relations Strategies Effectively

Overcoming this challenge requires a few key steps. Here are the main areas to focus on when tailoring investor relations strategies to make progress:

- Segment investors by type and information needs: Conduct surveys and create detailed profiles for effective stakeholder engagement in finance.

- Develop targeted messaging for each group: Craft value propositions and test messages, focusing on tailored IR messaging for analyst community.

- Create personalized thank-you notes and updates: Write personalized messages and schedule updates as part of shareholder relationship management.

- Implement data analytics for investor insights: Track behavior and analyze trends to enhance investor communication techniques.

- Design tailored content for different platforms: Create platform-specific content, customizing IR presentations for diverse audiences.

- Establish regular feedback loops with key investors: Schedule feedback sessions and gather insights to improve corporate disclosure strategies.

- Optimize timing and format of investor events: Plan around key dates and offer various event formats, considering both institutional investor outreach and retail investor targeting.

Let’s dive in!

1: Segment investors by type and information needs

Understanding your investors’ diverse needs is critical for effective communication and tailoring investor relations strategies.

Actionable Steps:

- Conduct a survey to gather insights into investors’ preferences and information needs, focusing on stakeholder engagement in finance.

- Use CRM tools to create detailed profiles for each investor segment, enhancing shareholder relationship management.

- Regularly update these profiles based on new interactions and feedback to improve investor communication techniques.

Explanation:

By segmenting investors, you can tailor communications to meet their specific needs, enhancing engagement and trust. Using CRM tools helps manage this data efficiently, ensuring your messages are always relevant and aligning with corporate disclosure strategies.

For more insights on leveraging data, check out this resource on using data analytics to improve investor relations strategy.

These steps set a solid foundation for personalized investor relations and customizing IR presentations.

2: Develop targeted messaging for each group

Creating tailored messaging for different investor groups is essential to enhance engagement and build trust when tailoring investor relations strategies.

Actionable Steps:

- Craft specific value propositions: Highlight what matters most to each investor segment, focusing on customizing IR presentations.

- Use storytelling techniques: Make your messages more engaging and relatable, enhancing stakeholder engagement in finance.

- Test different messaging strategies: Use A/B testing to see what resonates best with various investor communication techniques.

Key elements of effective targeted messaging:

- Clear and concise language for shareholder relationship management

- Relevant data and metrics for institutional investor outreach

- Compelling call-to-action for retail investor targeting

Explanation:

These steps ensure that your communications are relevant and impactful, ultimately fostering stronger relationships. Tailoring investor relations strategies helps meet the unique needs of each group, boosting engagement and improving corporate disclosure strategies.

For more insights, visit this resource on strengthening investor relations.

This approach lays the foundation for effective investor communication and builds lasting trust, incorporating financial transparency best practices and ESG reporting for diverse stakeholders.

3: Create personalized thank-you notes and updates

Creating personalized thank-you notes and updates is crucial to tailoring investor relations strategies and maintaining strong investor relationships.

Actionable Steps:

- Write personalized thank-you notes: Reference specific interactions or contributions to show genuine appreciation and enhance stakeholder engagement in finance.

- Schedule regular updates: Provide valuable insights and express gratitude regularly to keep investors informed, improving investor communication techniques.

- Mix handwritten and digital updates: Cater to all preferences by using both handwritten notes and digital communications, supporting shareholder relationship management efforts.

Explanation:

These steps help build trust and show your investors that you value their support, essential for tailoring investor relations strategies.

Personalized thank-you notes and regular updates can significantly improve investor relations and contribute to effective institutional investor outreach.

For more insights, check out this resource on strengthening investor relations with gratitude.

Personalized communications can lead to stronger, more engaged investor relationships, supporting corporate disclosure strategies and financial transparency best practices.

4: Implement data analytics for investor insights

Incorporating data analytics into your investor relations strategies is essential for understanding and engaging your investors effectively, especially when tailoring investor relations strategies.

Actionable Steps:

- Track investor behavior: Use analytics tools to monitor how investors interact with your communications and presentations, improving stakeholder engagement in finance.

- Analyze engagement trends: Identify patterns and insights from the data to tailor future interactions and customize IR presentations.

- Set up real-time dashboards: Monitor key metrics to adjust your strategies as needed, enhancing shareholder relationship management.

Explanation:

These steps enable you to gain valuable insights into investor behavior and preferences. This approach helps tailor your communications and improve engagement, supporting effective institutional investor outreach.

Using data analytics ensures that your strategies are always informed by the latest trends. For more insights, visit this resource on using data analytics to improve investor relations strategy.

By leveraging data, you can enhance your investor relations and build stronger relationships, while tailoring investor relations strategies to meet diverse stakeholder needs.

5: Design tailored content for different platforms

Creating tailored content for different platforms is crucial to reach and engage various investor groups effectively, a key aspect of tailoring investor relations strategies.

Actionable Steps:

- Develop platform-specific content: Create LinkedIn posts targeting professional investors with industry insights and updates, enhancing stakeholder engagement in finance.

- Produce detailed reports: Write in-depth reports and presentations for institutional investors looking for comprehensive data, focusing on customizing IR presentations.

- Make engaging visuals: Design videos and infographics for retail investor targeting to make complex information accessible, improving shareholder relationship management.

Explanation:

These steps ensure your content resonates with different investor segments, enhancing engagement and communication as part of tailoring investor relations strategies.

Tailoring content to specific platforms helps meet the unique needs of each group, supporting corporate disclosure strategies. For more insights, visit this resource on successful Capital Markets Days.

Effective content design strengthens relationships and builds trust across all investor types, aligning with financial transparency best practices and tailored IR messaging for analyst community.

6: Establish regular feedback loops with key investors

Regularly gathering feedback from key investors is crucial for tailoring investor relations strategies and building strong, lasting relationships.

Actionable Steps:

- Schedule quarterly feedback sessions: Arrange meetings with top investors to discuss their concerns and suggestions, enhancing stakeholder engagement in finance.

- Use online surveys and polls: Collect feedback from a wider investor base to gain diverse insights for customizing IR presentations.

- Implement changes based on feedback: Act on the feedback received and communicate these improvements to your investors, improving shareholder relationship management.

Benefits of establishing regular feedback loops:

- Improved investor satisfaction through tailored IR messaging for analyst community

- Enhanced decision-making in corporate disclosure strategies

- Increased transparency in financial transparency best practices

Explanation:

These steps help ensure you stay connected with your investors and address their needs effectively. Regular feedback loops facilitate open communication and continuous improvement in tailoring investor relations strategies.

This approach aligns with current industry trends in stakeholder engagement.

Consistently gathering feedback fosters trust and strengthens investor relations, supporting institutional investor outreach and retail investor targeting efforts.

7: Optimize timing and format of investor events

Optimizing the timing and format of your investor events is crucial for maximizing engagement and impact when tailoring investor relations strategies.

Actionable Steps:

- Plan events around key financial reporting dates: Schedule investor events to coincide with important financial updates, ensuring timely and relevant information for institutional investor outreach.

- Offer a mix of event formats: Provide in-person, virtual, and hybrid events to accommodate different preferences and maximize attendance, enhancing stakeholder engagement in finance.

- Use interactive tools: Incorporate live polls and Q&A sessions to engage participants and gather real-time feedback, improving investor communication techniques.

Key factors to consider when optimizing investor events:

- Investor availability and time zones

- Technological capabilities

- Content relevance and depth for customizing IR presentations

Explanation:

These steps help ensure your investor events are well-timed, accessible, and engaging. By planning around key dates and offering varied formats, you can cater to the diverse needs of your investors, supporting effective shareholder relationship management.

Using interactive tools enhances participation and provides valuable insights for tailoring investor relations strategies. For more details, check out this resource on successful Capital Markets Days.

Consistently optimizing your event timing and format leads to better investor relations and stronger engagement, aligning with financial transparency best practices.

Partner with Alleo for Tailored Investor Relations

We’ve explored the challenges of tailoring investor relations strategies for different stakeholders. Did you know you can work with Alleo to make this journey easier? Our expertise in customizing IR presentations and stakeholder engagement in finance can help you streamline your approach.

Set up your account and create a personalized plan for tailoring investor relations strategies. Alleo’s AI coach follows up on your progress, handles changes, and keeps you accountable with text and push notifications. We assist you in refining your corporate disclosure strategies and institutional investor outreach.

Ready to get started for free? Let me show you how to enhance your investor communication techniques and shareholder relationship management!

Step 1: Log In or Create Your Account

To start tailoring your investor relations strategy with Alleo, Log in to your account or create a new one to access personalized guidance and tools for effective stakeholder engagement.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your investor relations strategy with your broader career objectives, helping you tailor your approach for maximum impact and stakeholder satisfaction.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to get tailored guidance on improving your investor relations strategies, helping you effectively manage diverse stakeholder needs and optimize your financial communications.

Step 4: Starting a coaching session

Begin your investor relations journey with Alleo by scheduling an intake session, where you’ll set up a personalized plan to tailor your communication strategies for different stakeholders.

Step 5: Viewing and Managing Goals After the Session

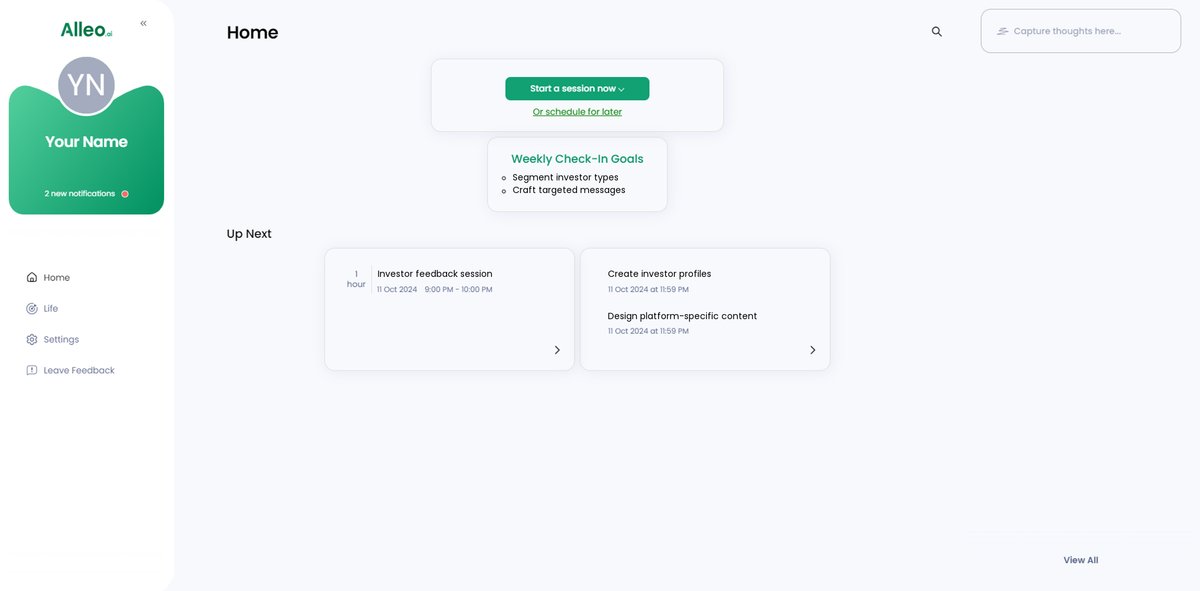

After your coaching session on tailoring investor relations strategies, you’ll find the goals you discussed displayed on the home page of the Alleo app, allowing you to easily track and manage your progress in implementing personalized approaches for different investor groups.

Step 6: Adding events to your calendar or app

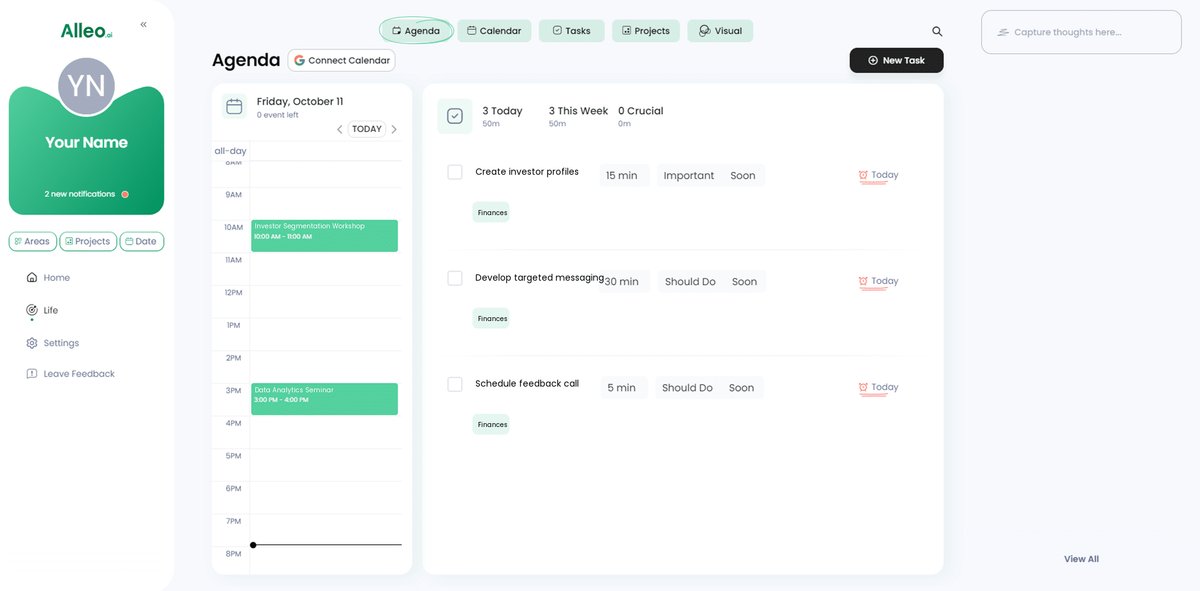

Use Alleo’s calendar and task features to add key investor events, feedback sessions, and update schedules, allowing you to easily track your progress in tailoring your investor relations strategy and stay accountable to your goals.

Bringing It All Together: Tailoring Your Investor Relations

We’ve covered a lot, haven’t we?

By now, you understand the importance of tailoring investor relations strategies through segmenting investors, crafting targeted messages, and using data analytics. Each step helps you connect with your investors in a meaningful way, enhancing stakeholder engagement in finance.

Remember, it’s about building trust and engagement through effective investor communication techniques.

You’ve got this!

As a coach, I’ve seen how personalized strategies can transform investor relations, from customizing IR presentations to improving shareholder relationship management.

So, start implementing these techniques today, including corporate disclosure strategies and institutional investor outreach.

Alleo can guide you every step of the way, making the process of tailoring investor relations strategies easier and more efficient.

Ready to tailor your investor relations strategy? Try Alleo for free and see the difference in your financial transparency best practices!