How to Boost Investor Transparency During Your Company’s Relisting Process

Imagine being an investor in a promising startup, only to be left in the dark about crucial relisting processes. Improving investor transparency during relisting is essential for maintaining trust and compliance with SEC regulations for relisting.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, transparency is key to maintaining investor trust and adhering to corporate governance best practices.

In this article, you’ll discover effective strategies for improving investor transparency during relisting. We’ll explore actionable steps to establish clear communication, provide detailed timelines, and create a helpful investor FAQ. These investor communication strategies can significantly enhance stock market transparency measures.

Ready to transform your investor relations and ensure proper financial disclosure requirements are met?

Let’s dive in and explore company relisting procedures that prioritize shareholder rights during relisting.

The Consequences of Poor Transparency in Relisting

When companies fail to communicate effectively during the relisting process, it can lead to significant investor frustration. Many clients initially struggle with understanding timelines and requirements, causing anxiety and distrust. Improving investor transparency during relisting is crucial for maintaining confidence.

This lack of clarity can damage your company’s reputation in the financial markets and hinder compliance with SEC regulations for relisting.

In my experience, people often find that poor communication leads to missed opportunities for investor engagement. Imagine the impact of investors feeling uncertain about their investments due to vague updates. Effective investor communication strategies are essential for stock market transparency measures.

It’s a painful reality that can erode trust and loyalty, affecting shareholder rights during relisting.

Several clients report that timely and clear information dramatically improves investor relations. Establishing transparency is not just beneficial; it’s crucial for maintaining confidence and support. Implementing corporate governance best practices and adhering to financial disclosure requirements are key to improving investor transparency during relisting.

Key Steps to Improve Transparency in Relisting Processes

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in improving investor transparency during relisting:

- Establish clear communication channels: Create multiple platforms to keep investors informed about company relisting procedures.

- Provide detailed relisting timelines: Share and regularly update timelines with investors, adhering to SEC regulations for relisting.

- Create investor FAQ on relisting process: Address common questions and concerns in a dedicated FAQ, covering shareholder rights during relisting.

- Host regular investor update meetings: Hold meetings to provide updates and address questions, demonstrating corporate governance best practices.

- Publish progress reports on listing requirements: Share detailed reports on compliance and progress, focusing on financial disclosure requirements and regulatory compliance for relisted firms.

Let’s dive in!

1: Establish clear communication channels

Creating clear communication channels is essential for improving investor transparency during relisting and maintaining investor trust throughout the process.

Actionable Steps:

- Develop a dedicated portal for investor relations on your company’s website. This will serve as a central hub for updates and support stock market transparency measures.

- Appoint an investor relations officer to manage communications and respond to investor inquiries promptly, adhering to corporate governance best practices.

- Utilize various investor communication strategies, such as email newsletters and social media, to keep investors informed regularly about company relisting procedures.

Explanation: Establishing these channels ensures investors receive timely and accurate information, reducing uncertainty and aligning with financial disclosure requirements.

According to Investopedia, maintaining clear communication helps companies meet listing requirements and retain investor confidence. This approach aligns with current trends emphasizing transparency in financial markets and supports regulatory compliance for relisted firms.

Key benefits of clear communication channels include:

- Enhanced investor trust and confidence in the relisting process

- Reduced misinformation and speculation, supporting due diligence in company relisting

- Improved company-investor relationships, addressing shareholder rights during relisting

Implementing these steps will lay a solid foundation for effective investor relations and improve investor transparency during relisting.

2: Provide detailed relisting timelines

Providing detailed relisting timelines is vital for improving investor transparency during relisting and ensuring they are well-informed throughout the process.

Actionable Steps:

- Create a publicly accessible relisting timeline with key milestones. Ensure each milestone has a clear deadline and a brief description, adhering to company relisting procedures.

- Regularly update the timeline based on progress and any changes in the process. Keep investors informed about any delays or advancements, following investor communication strategies.

- Share the timeline through multiple investor communication channels, such as email newsletters and social media updates, to enhance stock market transparency measures.

Explanation: Providing a clear and detailed relisting timeline helps investors understand what to expect and when. This transparency reduces uncertainty and builds trust, aligning with corporate governance best practices.

According to Investopedia, maintaining clear communication and timelines is essential for meeting listing requirements and retaining investor confidence. Ensuring that updates are timely and accurate aligns with current industry trends emphasizing transparency and SEC regulations for relisting.

Implementing these steps will help you keep your investors informed and engaged, fostering a stronger relationship while improving investor transparency during relisting.

3: Create investor FAQ on relisting process

Creating an investor FAQ on the relisting process helps address common concerns and fosters transparency, which is crucial for improving investor transparency during relisting.

Actionable Steps:

- Gather frequent investor questions about company relisting procedures using surveys and feedback forms.

- Draft clear and comprehensive answers with the help of legal and financial advisors, focusing on stock market transparency measures.

- Publish the FAQ on your investor relations portal and promote it through investor communication strategies.

Explanation: Providing a detailed FAQ ensures investors have easy access to critical information about regulatory compliance for relisted firms.

This enhances clarity and trust, which are essential for improving investor transparency during relisting.

According to AHP, transparent communication is key to maintaining investor confidence during relisting.

Ensuring your FAQ is easily accessible and regularly updated is essential for shareholder rights during relisting.

By implementing these steps, you can significantly improve your communication strategy and keep investors well-informed about due diligence in company relisting.

4: Host regular investor update meetings

Hosting regular investor update meetings is crucial for improving investor transparency during relisting and building trust throughout the process.

Actionable Steps:

- Schedule monthly virtual or in-person investor meetings to enhance company relisting procedures.

- Track attendance and engagement to gauge interest and address concerns, aligning with stock market transparency measures.

- Provide detailed agendas and meeting summaries, adhering to financial disclosure requirements.

- Monitor the distribution and reception of these documents to ensure clarity and meet regulatory compliance for relisted firms.

- Invite key stakeholders to present updates and answer questions, supporting shareholder rights during relisting.

- Evaluate the quality of interactions and responses during the meetings to ensure due diligence in company relisting.

Explanation: Regular update meetings ensure that investors are well-informed and feel involved in the relisting process. These sessions provide a platform for addressing concerns and improving investor transparency during relisting.

According to AHP, clear communication is essential for maintaining investor confidence. By fostering open dialogue, you can enhance transparency and strengthen investor relations, aligning with SEC regulations for relisting.

Elements of successful investor update meetings:

- Clear, concise presentation of progress and challenges, following corporate governance best practices

- Open Q&A sessions to address investor concerns and support investor communication strategies

- Follow-up communications summarizing key points discussed, aiding in risk assessment for relisted companies

These steps will help you keep investors engaged and informed, paving the way for a successful relisting process and improving investor transparency during relisting.

5: Publish progress reports on listing requirements

Publishing progress reports on listing requirements keeps investors informed and reassured about your company’s compliance status, which is crucial for improving investor transparency during relisting.

Actionable Steps:

- Create quarterly progress reports detailing compliance with listing requirements and company relisting procedures.

- Ensure these reports are comprehensive and timely, adhering to financial disclosure requirements.

- Highlight any challenges and steps taken to address them, demonstrating corporate governance best practices.

- Transparency in reporting challenges and solutions, aligning with stock market transparency measures.

- Distribute reports through multiple channels as part of investor communication strategies.

- Track the reach and feedback on these reports from investors to assess shareholder rights during relisting.

Explanation: Regularly publishing progress reports fosters transparency and builds investor trust. This practice aligns with industry trends, such as the new IDX delisting and relisting rules, which emphasize clear communication and improving investor transparency during relisting.

Keeping investors informed about your progress helps maintain their confidence and support, especially during the company relisting procedures.

Key components of effective progress reports:

- Detailed updates on compliance with each listing requirement and SEC regulations for relisting

- Clear timeline for addressing any outstanding issues, demonstrating due diligence in company relisting

- Transparency about potential risks and mitigation strategies, aiding in risk assessment for relisted companies

These measures ensure that investors stay updated on your company’s status, aiding in effective investor relations and regulatory compliance for relisted firms.

Enhance Investor Transparency with Alleo

We’ve explored the challenges of improving investor transparency during relisting and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier, especially when it comes to company relisting procedures and investor communication strategies?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your transparency goals, focusing on stock market transparency measures and financial disclosure requirements.

Alleo’s AI coach will guide you through each actionable step, ensuring you adhere to SEC regulations for relisting and corporate governance best practices.

Alleo keeps you on track with reminders and progress updates. You’ll receive text and push notifications to keep you accountable, helping you maintain shareholder rights during relisting and conduct thorough risk assessments for relisted companies.

Embrace transparency in your investor relations with Alleo’s support, ensuring due diligence in company relisting and regulatory compliance for relisted firms.

Ready to get started for free? Let me show you how to improve investor transparency during relisting!

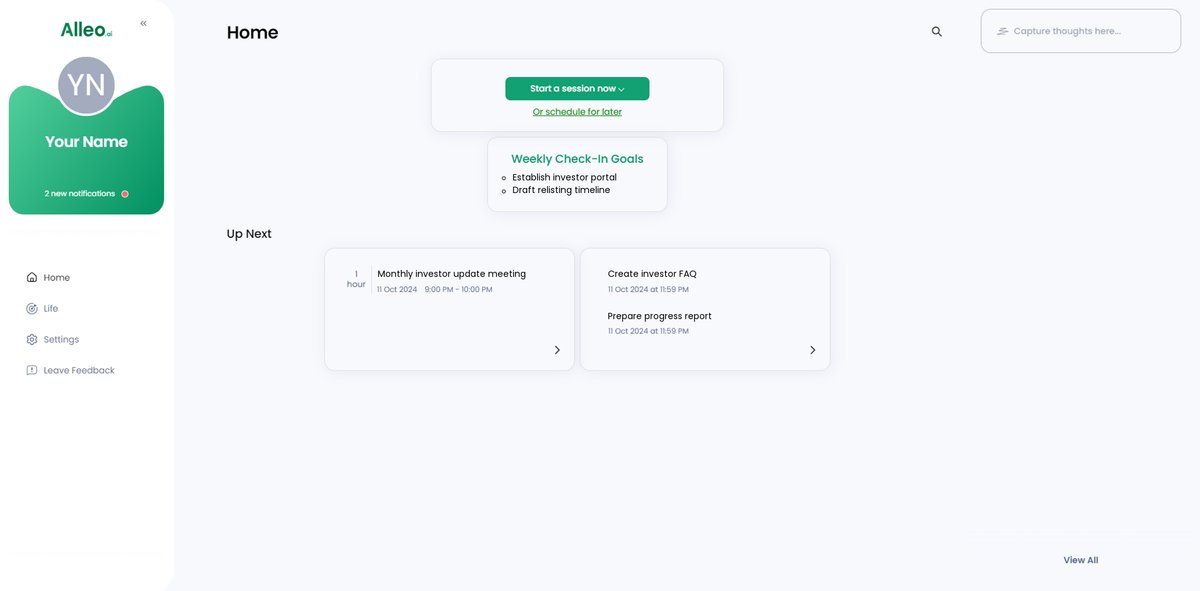

Step 1: Log In or Create Your Account

To start improving your investor transparency during the relisting process, log in to your Alleo account or create a new one if you haven’t already.

Step 2: Choose Your Transparency Goal

Select “Improving Investor Transparency” as your goal in Alleo to receive tailored guidance on enhancing communication during the relisting process, helping you build stronger relationships with your investors.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to receive tailored guidance on improving investor transparency and managing the relisting process effectively, helping you build stronger relationships with your investors and navigate financial challenges with confidence.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your investor transparency goals and create a personalized plan to improve your relisting communication strategy.

Step 5: Viewing and managing goals after the session

After your AI coaching session on improving investor transparency, check the Alleo app’s home page to view and manage the goals you discussed, helping you stay on track with your relisting process communication efforts.

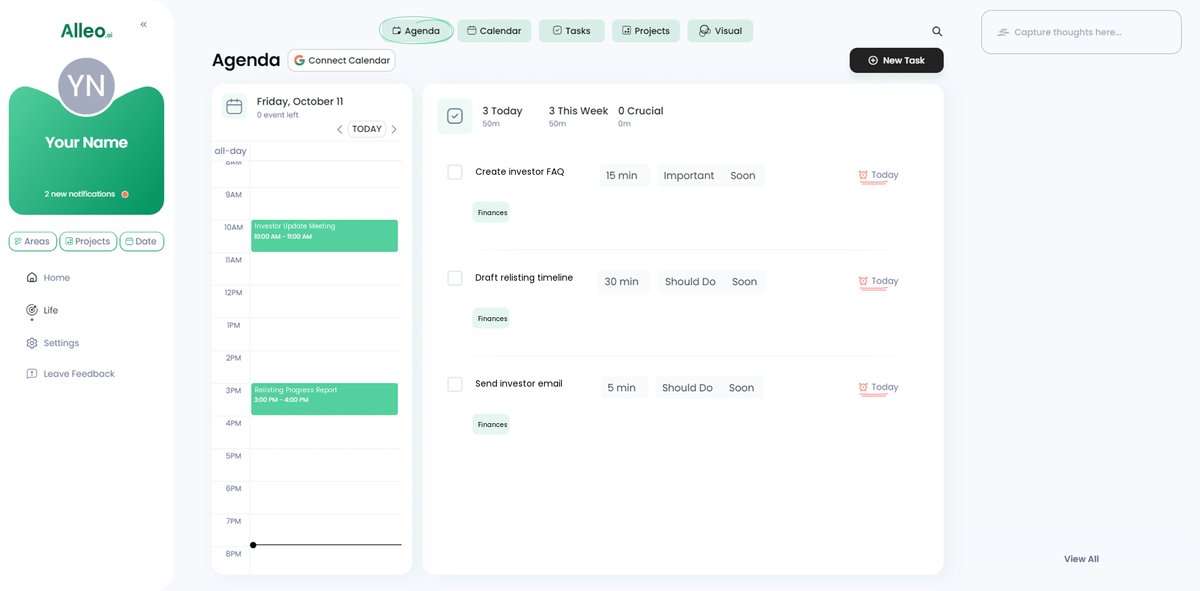

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track key investor communication events, such as update meetings and report releases, ensuring you stay on top of your transparency goals throughout the relisting process.

Embrace Transparency for Stronger Investor Relations

Improving investor transparency during relisting is essential for maintaining investor trust. We’ve discussed actionable steps to establish clear communication, provide detailed timelines, create an investor FAQ, host regular update meetings, and publish progress reports. These company relisting procedures help ensure compliance with SEC regulations for relisting.

As a startup founder, you understand the importance of investor confidence. By implementing these strategies, you’ll foster trust and strengthen your company’s reputation in the financial markets. Adopting corporate governance best practices and meeting financial disclosure requirements are crucial for improving investor transparency during relisting.

Remember, Alleo is here to assist you every step of the way. Our AI life coach can help you stay organized and ensure effective investor communication strategies throughout the relisting process.

Start enhancing your transparency efforts today and build a stronger relationship with your investors. Try Alleo for free and experience the difference in managing stock market transparency measures.