The Ultimate C-Level Guide: Mastering Investor Relations Communication for Executives

Imagine your startup is on the brink of a breakthrough, but you’re struggling to improve investor relations communication and articulate your vision and strategy to investors.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience helping clients stand out in competitive industries and enhance their executive presentation skills for investor meetings, I often encounter similar obstacles.

In this article, you’ll discover specific strategies to improve investor relations communication for C-level executives. We’ll explore developing a multi-year communications strategy, implementing regular feedback sessions to build trust with shareholders, creating crisis communication plans for investor relations, and enhancing ESG reporting for C-level executives.

Let’s dive into these effective investor communication strategies.

Understanding the Communication Challenges in Investor Relations

Navigating the complexities of investor communications can be daunting. Many clients initially struggle with bridging the gap between company leadership and diverse investor groups, highlighting the need to improve investor relations communication.

This disconnect often leads to misaligned expectations and miscommunications, underscoring the importance of effective investor communication strategies.

Timely dissemination of financial information is crucial. Yet, I frequently observe that startups falter due to inconsistent updates and unclear strategies, emphasizing the need for C-suite transparency in financial reporting.

These lapses can erode trust and investor confidence, making building trust with shareholders a top priority.

Additionally, common pitfalls include poorly executed crisis communication plans and insufficient ESG reporting for C-level executives. Such missteps can severely impact a company’s reputation and valuation.

Effective investor relations require a proactive and structured approach to ensure clarity and consistency, including mastering executive presentation skills for investor meetings and navigating earnings calls successfully.

Overcoming these challenges requires a few key steps to improve investor relations communication. Here are the main areas to focus on to make progress:

- Develop a multi-year communications strategy: Conduct an audit, set goals, and create a detailed roadmap for effective investor communication strategies.

- Implement regular investor feedback sessions: Schedule calls, host investor days, and utilize feedback to enhance C-suite transparency in financial reporting and build trust with shareholders.

- Create crisis communication plans: Develop a crisis team, establish protocols, and train executives in crisis communication for investor relations and navigating earnings calls successfully.

- Enhance ESG reporting and storytelling: Integrate ESG metrics, craft narratives, and engage stakeholders through ESG reporting for C-level executives and financial storytelling for company leaders.

Let’s dive in!

1: Develop a multi-year communications strategy

A multi-year communications strategy is essential for improving investor relations communication and aligning your investor relations with long-term company goals.

Actionable Steps:

- Conduct a comprehensive audit of current communication practices and investor perceptions.

- Use surveys and interviews to gather feedback from investors, enhancing stakeholder engagement best practices.

- Set clear, measurable communication goals aligned with company objectives.

- Define key performance indicators (KPIs) for effective investor communication strategies.

- Create a detailed roadmap outlining communication initiatives and timelines.

- Develop a timeline for regular updates, press releases, and reports, focusing on C-suite transparency in financial reporting.

Explanation: These steps help ensure your communication strategy is comprehensive and aligned with your business objectives. Regular audits and feedback loops help maintain investor trust and improve investor relations communication.

For more insights on creating effective communication strategies, visit CIRI.

Key benefits of a well-structured strategy:

- Improved clarity in investor communications

- Better alignment with long-term business goals

- Enhanced trust and credibility with stakeholders, building trust with shareholders

A well-structured strategy provides clarity, making it easier to navigate investor relations and achieve your goals while improving investor relations communication.

2: Implement regular investor feedback sessions

Regular feedback sessions are crucial for understanding investor concerns and aligning strategies to improve investor relations communication.

Actionable Steps:

- Schedule quarterly investor calls to discuss recent developments and gather feedback, enhancing effective investor communication strategies.

- Prepare an agenda and key discussion points for each call, focusing on C-suite transparency in financial reporting.

- Host annual investor days to provide in-depth insights into company strategy and performance, building trust with shareholders.

- Organize presentations and Q&A sessions with senior leadership to showcase executive presentation skills for investor meetings.

- Utilize feedback to refine communication strategies and address investor concerns, navigating earnings calls successfully.

- Implement a feedback loop to track and act on investor suggestions, incorporating digital tools for investor relations management.

Explanation: These steps ensure consistent and transparent communication with investors, fostering trust and alignment, which is essential for improving investor relations communication.

Regular engagement helps identify issues early and adjust strategies accordingly, supporting crisis communication in investor relations.

For more insights on maintaining effective investor relations, visit Mergers & Inquisitions.

Consistently engaging with investors through feedback sessions can significantly enhance trust and improve your investor relations strategy, incorporating stakeholder engagement best practices and financial storytelling for company leaders.

3: Create crisis communication plans

Creating crisis communication plans is essential for maintaining investor confidence during unexpected events and is a crucial aspect to improve investor relations communication.

Actionable Steps:

- Develop a crisis management team and assign roles and responsibilities.

- Conduct crisis simulation exercises to ensure preparedness for effective investor communication strategies.

- Establish clear protocols for internal and external communication during a crisis.

- Draft template messages for various crisis scenarios to enhance stakeholder engagement best practices.

- Train C-level executives on effective crisis communication techniques to improve investor relations communication.

- Organize workshops and role-playing sessions to enhance executive presentation skills for investor meetings.

Explanation: These steps ensure that your team is well-prepared to handle crises effectively, minimizing potential damage to your company’s reputation and maintaining C-suite transparency in financial reporting.

Regular training and clear protocols help maintain transparency and trust with investors. For more insights on the importance of crisis communication in investor relations, visit VRS.

Essential components of a crisis communication plan to improve investor relations communication:

- Clear chain of command and decision-making processes for navigating earnings calls successfully

- Pre-approved messaging templates for various scenarios to enhance financial storytelling for company leaders

- Regular drills and simulations to test plan effectiveness and build trust with shareholders

Effective crisis communication plans can significantly bolster investor confidence and protect your company’s reputation, ultimately helping to improve investor relations communication.

4: Enhance ESG reporting and storytelling

Enhancing ESG reporting and storytelling is crucial for demonstrating your company’s commitment to sustainability and transparency, which is key to improve investor relations communication.

Actionable Steps:

- Integrate ESG metrics into regular financial reporting, focusing on C-suite transparency in financial reporting.

- Identify key ESG indicators relevant to your industry.

- Craft compelling narratives around your company’s sustainability efforts, utilizing financial storytelling for company leaders.

- Develop case studies and success stories highlighting ESG initiatives.

- Engage with stakeholders through various channels to promote transparency, following stakeholder engagement best practices.

- Use social media, webinars, and newsletters to share ESG progress.

Explanation: These steps ensure that your ESG efforts are visible and resonate with investors. Clear and consistent ESG reporting can enhance trust and attract sustainable investment, ultimately helping to improve investor relations communication.

For more insights on effective ESG reporting, visit Columbia Business School.

Key elements of effective ESG storytelling:

- Quantifiable metrics and targets

- Authentic narratives showcasing real impact

- Transparent reporting on challenges and progress

Strengthening your ESG narrative can significantly boost investor confidence and support long-term growth, serving as one of the effective investor communication strategies.

Partner with Alleo to Enhance Your Investor Relations

We’ve explored the challenges of improving investor relations communication for C-level executives and outlined the steps to achieve success. But did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple. Start by creating a personalized plan tailored to your needs to improve investor relations communication.

Our AI coach will help you schedule and organize regular investor feedback sessions, enhancing stakeholder engagement best practices. You can also set and track communication goals and KPIs, supporting effective investor communication strategies.

Alleo supports you in developing and refining crisis communication plans for investor relations. Additionally, it enhances financial storytelling for company leaders and ESG reporting for C-level executives through AI-driven insights.

The AI coach will follow up on your progress and keep you accountable via text and push notifications, helping you navigate earnings calls successfully and build trust with shareholders.

Ready to get started for free? Let me show you how to improve your investor relations communication!

Step 1: Logging in or Creating an Account

To begin enhancing your investor relations with AI-driven insights, Log in to your account or create a new one to access Alleo’s personalized communication strategies and tools.

Step 2: Choose Your Investor Relations Focus Area

Select “Enhancing Investor Communications” from the goals menu to align your efforts with the strategies outlined in the article, such as developing a multi-year plan or improving ESG reporting, to effectively address your investor relations challenges.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area in Alleo to specifically address investor relations challenges, aligning the AI coach’s guidance with strategies for improving communication with stakeholders and enhancing your professional performance in this critical aspect of business leadership.

Step 4: Starting a coaching session

Begin with an intake session to set up your personalized investor relations plan, allowing our AI coach to understand your specific needs and goals for improving communication with investors.

Step 5: Viewing and Managing Goals After the Session

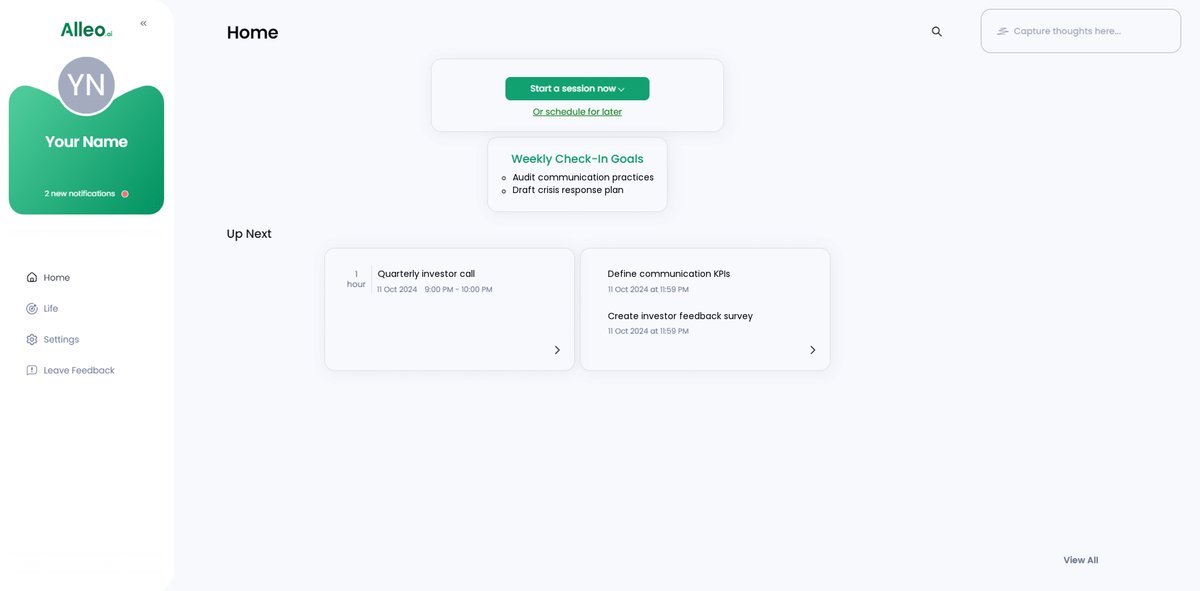

After your investor relations coaching session, open the Alleo app to find your discussed goals conveniently displayed on the home page, allowing you to easily track and manage your progress in improving communication with investors.

Step 6: Adding events to your calendar or app

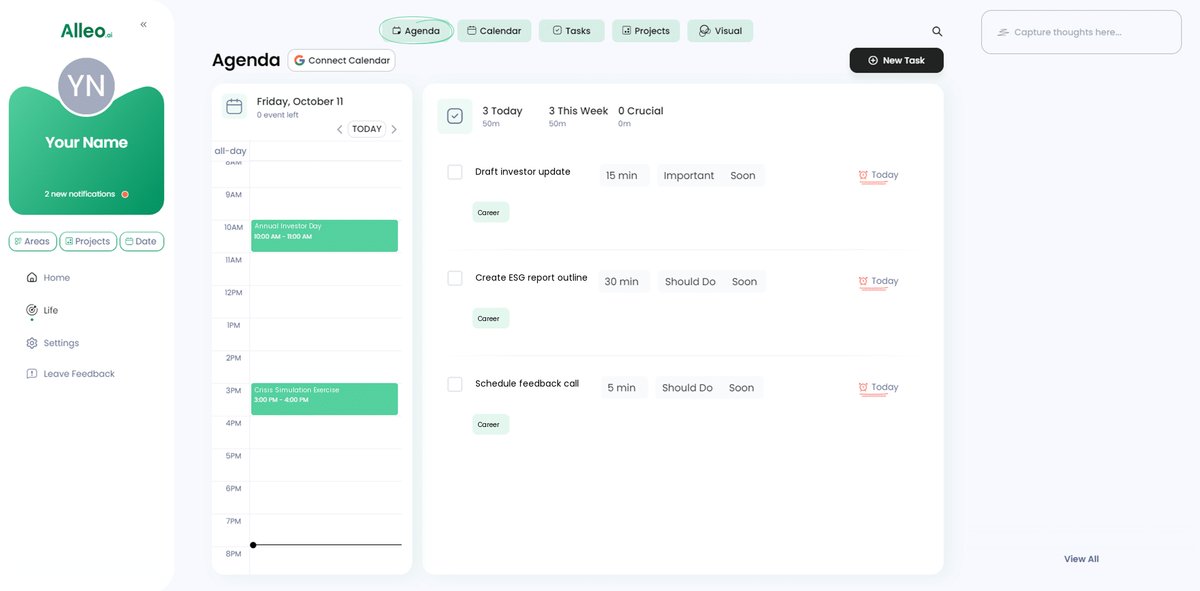

Use Alleo’s calendar and task features to schedule and track investor feedback sessions, communication goals, and ESG reporting milestones, helping you stay organized and accountable in improving your investor relations strategy.

Wrapping Up: Mastering Investor Relations Communication

As we conclude, remember that clear and strategic communication is key to successful investor relations. We’ve explored essential strategies to improve investor relations communication, including developing a multi-year plan, regular feedback sessions, crisis communication in investor relations, and enhancing ESG reporting for C-level executives.

It’s normal to feel overwhelmed, but you don’t have to tackle effective investor communication strategies alone.

Alleo is here to help you streamline these processes and enhance your investor communications with AI-driven insights, supporting C-suite transparency in financial reporting and building trust with shareholders.

Take the next step. Empower your startup’s investor relations and see the difference for yourself in navigating earnings calls successfully.

Try Alleo for free today and transform your investor communications, improving stakeholder engagement best practices.