The Ultimate Guide: How Financial Advisors Can Combine Expertise with Effective Networking

Are you finding it difficult to balance your financial expertise with the need to network effectively? Financial advisor networking strategies can be challenging to master.

As a life coach, I’ve worked with many financial advisors like you who excel technically but struggle to connect with potential clients. In my experience, the key lies in blending your technical skills with strong, relationship-building strategies in finance.

In this article, you’ll discover actionable steps to enhance your networking skills for financial planners without compromising your technical proficiency. We will explore methods such as adopting a client-centric approach, leveraging financial industry networking events, and building a robust COI network. These client acquisition techniques for advisors can significantly boost your success.

Let’s dive in and explore effective financial advisor networking strategies.

The Challenge of Balancing Expertise with Effective Networking

Many financial advisors struggle to strike the right balance between showcasing their technical expertise and effectively implementing financial advisor networking strategies. In my experience, people often find that despite their deep knowledge in financial planning, they miss opportunities because they haven’t built strong professional relationships in finance.

The evolving landscape of client acquisition techniques for advisors adds to this challenge. Traditional tactics like cold calling and seminars aren’t as effective as they once were, as clients now seek personalized, long-term relationships. Financial industry networking events are becoming increasingly important for advisors.

Financial advisors must now develop strong interpersonal skills alongside their technical knowledge. This shift requires more than just attending industry events; it demands a client-centric approach and regular, meaningful interactions. Leveraging LinkedIn for financial advisors and exploring digital networking for financial professionals are becoming crucial skills.

These changes can be tough to navigate, but they’re essential in today’s market. Balancing expertise and relationship-building in finance is key to success.

Key Steps to Combine Financial Expertise with Networking

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with financial advisor networking strategies:

- Develop a Client-Centric Approach to Networking: Understand client needs and personalize communication, enhancing client acquisition techniques for advisors.

- Attend Industry Events and Educational Webinars: Engage with peers at financial industry networking events and stay updated on industry trends.

- Create a COI Network and Communicate Regularly: Build professional relationships in finance with key professionals and maintain regular contact.

- Share Expertise through Workshops and Seminars: Organize and participate in educational events, showcasing networking skills for financial planners.

- Leverage Social Media for Thought Leadership: Create and share informative content, focusing on digital networking for financial professionals.

- Offer Pro Bono Consultations for Experience: Provide free financial planning sessions to build trust and enhance referral marketing in financial services.

- Join Professional Associations and Committees: Get involved in industry organizations and seek leadership roles, fostering collaborative partnerships in wealth management.

Let’s dive in!

1: Develop a client-centric approach to networking

A client-centric approach to networking places your clients’ needs and preferences at the forefront, fostering long-term relationships. This is a crucial financial advisor networking strategy that can significantly improve your success in the industry.

Actionable Steps:

- Conduct detailed client interviews to uncover financial goals, risk tolerance, and preferences.

- Regularly update client profiles to reflect changing needs and preferences.

- Send personalized emails or messages addressing specific client concerns or milestones.

Explanation: By understanding your clients on a deeper level, you can tailor your services to meet their unique needs. This approach not only builds trust but also enhances client satisfaction and loyalty, which are key elements in successful financial advisor networking strategies.

For instance, modern clients desire advisors who understand their unique financial goals and values. Personalized communication ensures you stay relevant and valuable to your clients, a crucial aspect of building professional relationships in finance.

Key benefits of a client-centric approach:

- Increased client retention

- Higher referral rates

- Improved client satisfaction

Developing a client-centric approach sets a strong foundation for effective networking and is one of the most valuable client acquisition techniques for advisors in the financial services industry.

![]()

2: Attend industry events and educational webinars

Attending industry events and educational webinars is essential for financial advisor networking strategies, helping you stay updated on trends and expand your professional network in finance.

Actionable Steps:

- Identify key industry conferences: Research and attend top financial industry networking events relevant to your niche. Network with peers and industry leaders to build professional relationships in finance.

- Participate in educational webinars: Join webinars offering CE credits. Stay updated on the latest trends and actively participate in Q&A sessions to showcase your expertise and enhance your networking skills for financial planners.

Explanation: Attending these events helps you connect with industry peers and stay informed about new developments, supporting your client acquisition techniques for advisors.

For example, participating in webinars from the Financial Experts Network can enhance your knowledge and credibility, contributing to your financial advisor networking strategies.

These steps ensure you remain relevant and connected in the financial advisory field, balancing expertise and relationship-building in finance.

3: Create a COI network and communicate regularly

Creating a COI network and maintaining regular communication is crucial for financial advisor networking strategies to expand their reach and build trust.

Actionable Steps:

- Identify key professionals: Make a list of CPAs, estate attorneys, and other COIs who can refer clients to you. Schedule introductory meetings to establish connections and build professional relationships in finance.

- Schedule regular updates: Set a monthly schedule for reaching out to your COI network. Share relevant insights or updates that could benefit them and their clients, leveraging digital networking for financial professionals.

- Organize collaborative events: Plan events like joint seminars or webinars with your COI network. This helps to cross-promote services and build stronger relationships, acting as financial industry networking events.

Explanation: By building and maintaining a COI network, you foster valuable relationships that can lead to high-quality referrals. Regular communication ensures you stay top-of-mind and demonstrate ongoing value, which is essential for client acquisition techniques for advisors.

According to Grant Hicks, top financial advisors communicate more frequently with their COI network than with clients and prospects. This strategy helps you stay relevant and expand your professional influence, effectively leveraging LinkedIn for financial advisors.

These steps will help you build a strong COI network, essential for successful client acquisition and implementing effective financial advisor networking strategies.

4: Share expertise through workshops and seminars

Sharing your expertise through workshops and seminars is a crucial financial advisor networking strategy for demonstrating your knowledge while building trust with potential clients.

Actionable Steps:

- Host financial literacy workshops: Organize workshops focused on financial education topics for clients and prospects. Provide actionable tips and take-home materials, leveraging these events as client acquisition techniques for advisors.

- Participate in community seminars: Volunteer to speak at local community events or seminars. Focus on educating attendees while subtly promoting your services, balancing expertise and relationship-building in finance.

Explanation: Providing educational workshops and seminars allows you to showcase your expertise and connect with potential clients, serving as effective financial industry networking events.

This approach fosters trust and positions you as a thought leader, enhancing your networking skills for financial planners.

For example, participating in events hosted by the Financial Experts Network can enhance your credibility and reach, supporting your financial advisor networking strategies.

These steps will help you establish yourself as a knowledgeable and approachable financial advisor, paving the way for stronger client relationships and building professional relationships in finance.

5: Leverage social media for thought leadership

Leveraging social media for thought leadership is crucial for financial advisors to establish credibility and connect with potential clients. This is a key component of effective financial advisor networking strategies.

Actionable Steps:

- Create informative content: Share regular blog posts or LinkedIn articles on financial planning topics. Highlight case studies or client success stories (with permission). This approach aids in building professional relationships in finance.

- Engage with your audience: Respond to comments and questions on your social media posts. Join relevant online groups and participate in discussions, which can serve as digital networking for financial professionals.

Explanation: By consistently sharing valuable content and engaging with your audience, you position yourself as a trusted expert in the field, enhancing your networking skills for financial planners.

This approach not only builds your online presence but also fosters trust and credibility. For example, participating in discussions on platforms like Financial Experts Network can enhance your visibility and reach, making it an excellent client acquisition technique for advisors.

Effective social media strategies for financial advisors:

- Share market insights and analysis

- Post educational infographics

- Conduct live Q&A sessions, which can serve as virtual financial industry networking events

These steps will help you establish a strong online presence, making it easier to attract and retain clients while leveraging LinkedIn for financial advisors and other platforms.

6: Offer pro bono consultations for experience

Offering pro bono consultations is a great way to build trust and gain valuable experience in the financial advisory field, serving as one of the effective financial advisor networking strategies.

Actionable Steps:

- Provide free initial consultations: Offer complimentary financial planning sessions to attract potential clients. Use these sessions to demonstrate your expertise and build professional relationships in finance.

- Volunteer with nonprofits: Partner with local nonprofits to offer financial advice to underserved communities. Gain experience while giving back to the community, enhancing your networking skills for financial planners.

Explanation: These steps matter because they help you showcase your expertise and build relationships with potential clients, which are crucial client acquisition techniques for advisors.

Providing free consultations allows clients to experience your services firsthand, increasing the likelihood of them becoming paying clients. This approach balances expertise and relationship-building in finance.

Volunteering also expands your network and enhances your professional reputation. For example, participating in initiatives like those offered by the Financial Experts Network can provide valuable exposure and experience, similar to attending financial industry networking events.

These actions will help you build a strong foundation of trust and experience, paving the way for future success in your financial advisor networking strategies.

7: Join professional associations and committees

Joining professional associations and committees is vital for expanding your network and growing your influence in the industry. It’s one of the most effective financial advisor networking strategies.

Actionable Steps:

- Become an active member: Join professional associations like the CFP Board or FPA. Participate in their events and engage with other members, focusing on building professional relationships in finance.

- Volunteer for leadership roles: Seek leadership positions within these organizations. Increase your visibility and influence in the industry, enhancing your networking skills for financial planners.

- Attend committee meetings: Regularly attend committee meetings and contribute to discussions. This helps you stay informed and build relationships with peers, supporting client acquisition techniques for advisors.

Explanation: These steps matter because they connect you with industry leaders and peers, expanding your professional network. By actively participating, you gain insights and opportunities that enhance your career and improve your financial advisor networking strategies.

For example, associations like the Financial Experts Network offer valuable resources and networking opportunities, including financial industry networking events.

Benefits of joining professional associations:

- Access to industry resources and research

- Opportunities for professional development

- Enhanced credibility in the field

These actions will support your growth and establish you as a committed and influential professional in the financial advisory field, balancing expertise and relationship-building in finance.

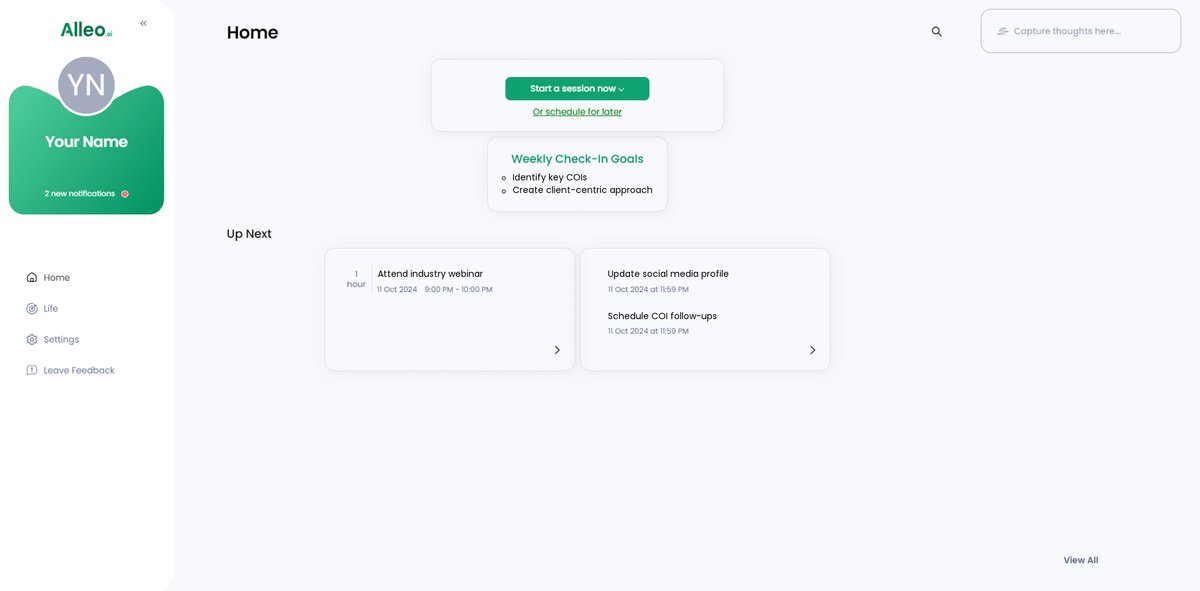

Partner with Alleo to Elevate Your Networking and Financial Expertise

We’ve explored balancing financial expertise with effective networking. But did you know you can work directly with Alleo to make this journey easier and faster for implementing financial advisor networking strategies?

Getting Started with Alleo:

- Set Up an Account: Create your account on Alleo’s platform in minutes to start improving your client acquisition techniques for advisors.

- Personalized Plan: Develop a tailored plan with Alleo’s AI coach to address your specific challenges in building professional relationships in finance.

- Coaching Support: Receive full coaching sessions, similar to a human coach, to refine both your technical and networking skills for financial planners.

- Progress and Accountability: The coach will follow up on your progress, manage changes, and keep you accountable through text and push notifications, helping you master digital networking for financial professionals.

Ready to get started for free and enhance your financial advisor networking strategies?

Let me show you how!

Step 1: Logging In or Creating an Account

To begin your journey of balancing financial expertise with effective networking, Log in to your account or create a new one on Alleo’s platform to access personalized coaching and networking strategies.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your financial expertise with effective networking strategies, helping you overcome the challenges discussed in the article and achieve a balanced approach to client relationships and business growth.

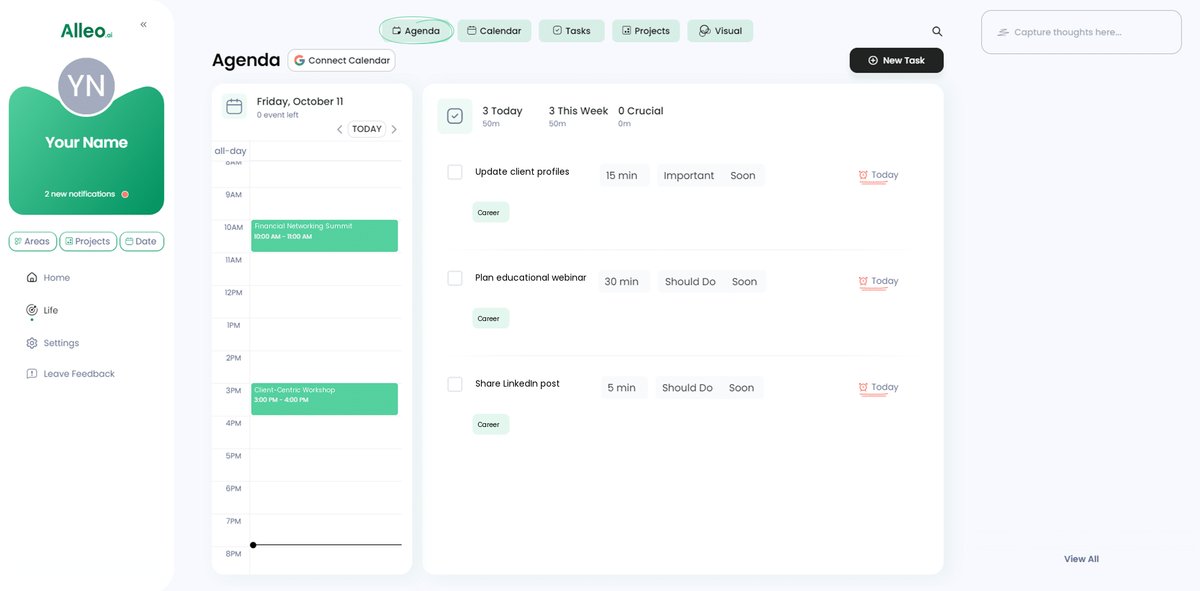

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area in the Alleo AI coach to specifically address your challenges in balancing financial expertise with networking skills, helping you enhance your professional growth and client relationships in the financial advisory field.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your financial expertise and networking goals to create a personalized plan for balancing these crucial skills.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to review and manage the financial advisory goals you discussed, ensuring you stay on track with your networking and expertise development plans.

Step 6: Adding events to your calendar or app

Use the app’s calendar feature to add networking events, client meetings, and professional development sessions, allowing you to track your progress in balancing financial expertise with effective networking.

Bringing It All Together: Mastering Financial Expertise and Networking

Balancing technical skills with effective financial advisor networking strategies is a challenge, but it’s possible. By focusing on a client-centric approach, attending financial industry networking events, and building a COI network, you can succeed in building professional relationships in finance.

Remember, leveraging social media like LinkedIn for financial advisors, offering pro bono consultations, and joining professional associations also play crucial roles in client acquisition techniques for advisors. These steps will help you build trust and establish your expertise while enhancing your networking skills for financial planners.

You don’t have to do it alone. Alleo is here to support you in balancing expertise and relationship-building in finance.

By following the actionable advice in this article, you’ll enhance both your technical and financial advisor networking strategies. This will lead to stronger client relationships and more successful outcomes in collaborative partnerships in wealth management.

Ready to elevate your career? Sign up for Alleo and start your journey in mastering referral marketing in financial services today!