Uncover Hidden Costs in Promotional Financing: 5 Essential Principles for Small Business Owners

Are you struggling to uncover the hidden costs of promotional financing for your small business? Evaluating promotional financing costs can be challenging, but it’s crucial for making informed decisions.

As a life coach, I understand the challenges small business owners face when evaluating financing options. It’s crucial to identify and manage these hidden fees in promotional financing to ensure your financial decisions are sound. Calculating the true cost of business loans is essential for your success.

In this article, you’ll learn specific strategies to evaluate promotional financing offers. We’ll cover comparing APR and fees, calculating cash flow impacts of financing deals, and more. Understanding the differences between short-term vs long-term financing costs can help you make better choices for your business.

Ready to dive into evaluating promotional financing costs and explore small business financing options?

Understanding the Hidden Costs in Promotional Financing Offers

Evaluating promotional financing costs can be tricky. Many clients initially struggle with understanding the true cost of business loans and the hidden fees in promotional financing.

Hidden costs often lurk in the fine print of loan agreements. For example, fees and penalties can significantly impact your cash flow and financial health when comparing different financing structures.

These hidden costs can lead to cash flow issues, making it difficult to meet ongoing expenses. In my experience, this can severely affect your ability to retain customers and fuel business growth, especially when evaluating promotional financing costs for small business financing options.

So, how do you avoid these pitfalls?

Let’s dive deeper into the specifics of evaluating promotional financing costs.

A Roadmap to Uncovering Hidden Costs in Promotional Financing

Evaluating promotional financing costs requires a few key steps. Here are the main areas to focus on when comparing different financing structures:

- Compare APR and Fees from Multiple Lenders: Research and compare APR, fees, and repayment terms for small business financing options.

- Calculate Impact on Daily Cash Flow: Estimate daily impact using cash flow calculators and simulations to understand the true cost of business loans.

- Analyze Repayment Terms and Hidden Conditions: Review fine print in loan agreements, repayment schedules, and eligibility criteria to uncover hidden fees in promotional financing.

- Assess Opportunity Cost of Alternative Options: Identify and compare alternative financing options, including business credit card promotional offers and short-term vs long-term financing costs.

- Review Customer Retention Impact of Financing: Analyze the impact on marketing budgets and customer satisfaction when evaluating promotional financing costs.

Let’s dive into evaluating promotional financing costs!

1: Compare APR and fees from multiple lenders

Understanding the true cost of promotional financing starts with comparing APR and fees from various lenders when evaluating promotional financing costs.

Actionable Steps:

- Research and compile a list of potential lenders offering promotional financing.

- Set criteria for comparison, such as APR, fees, and repayment terms.

- Use online resources and financial comparison tools to explore small business financing options.

- Create a detailed spreadsheet to compare the APR and fees of each lender.

- Include columns for each financial factor and lender.

- Regularly update the spreadsheet as you gather more information on hidden fees in promotional financing.

- Reach out to other small business owners or financial advisors for their insights on different lenders.

- Join relevant online forums or local business groups.

- Schedule consultations with financial experts to discuss calculating the true cost of business loans.

Key factors to consider when comparing lenders:

- Annual Percentage Rate (APR)

- Origination fees and other charges

- Repayment flexibility, including short-term vs long-term financing costs

Explanation:

Taking these steps ensures you have a clear understanding of the financial landscape, helping you make informed decisions. Comparing APR and fees helps you identify the most cost-effective options, reducing the risk of unexpected expenses when evaluating promotional financing costs.

For more guidance on choosing the best small business lender, visit National Business Capital.

By thoroughly comparing APR and fees, you set a strong foundation for evaluating other hidden costs in promotional financing, including the cash flow impact of financing deals.

2: Calculate impact on daily cash flow

Calculating the impact on daily cash flow is essential to understand how promotional financing affects your business’s financial health when evaluating promotional financing costs.

Actionable Steps:

- Use a cash flow calculator to estimate daily impacts.

- Input realistic revenue and expense projections.

- Consider seasonal variations in sales.

- Monitor your current cash flow patterns to identify potential stress points.

- Analyze historical financial data.

- Identify periods of high and low cash flow.

- Simulate different financing scenarios to understand their effects on your cash flow.

- Use financial modeling software or tools.

- Run multiple simulations to cover various scenarios, including short-term vs long-term financing costs.

Explanation:

Taking these steps ensures you can foresee potential cash flow issues and plan accordingly. Understanding the daily impact helps you make informed decisions and avoid unexpected financial strain when evaluating promotional financing costs.

For more insights on managing business cash flow and small business financing options, visit Investopedia.

By accurately calculating the daily cash flow impact, you can better manage your finances and maintain healthy operations while considering the true cost of business loans.

3: Analyze repayment terms and hidden conditions

Understanding repayment terms and hidden conditions is crucial when evaluating promotional financing costs to avoid unexpected expenses for small businesses.

Actionable Steps:

- Thoroughly review the fine print of each financing offer.

- Look for clauses related to early repayment penalties, variable interest rates for small business credit, and additional fees.

- Seek legal advice if needed for reading the fine print in loan agreements.

- Compare the repayment period and structure across different small business financing options.

- Create a repayment schedule for each option to calculate the true cost of business loans.

- Assess the cash flow impact of financing deals on your monthly budget.

- Check for any conditions that could affect your eligibility or access to future financing.

- Verify credit score requirements and other criteria for short-term vs long-term financing costs.

- Ensure that the financing terms align with your long-term business goals.

Common hidden fees in promotional financing to watch for:

- Balloon payments

- Prepayment penalties

- Variable interest rates

Explanation:

Taking these steps helps you avoid costly surprises and aligns your financing with your business goals. Reviewing fine print and repayment terms ensures you understand all conditions when evaluating promotional financing costs.

For more insights on evaluating financing offers, visit SBA’s guide on business financing.

By carefully analyzing repayment terms and hidden conditions, you can make informed decisions that support your business’s financial health and future growth, including comparing different financing structures and considering tax implications of business financing.

4: Assess opportunity cost of alternative options

Evaluating promotional financing costs and opportunity costs is essential to choose the best financing option for your business.

Actionable Steps:

- Identify alternative financing options. Research traditional loans, revenue-based financing, and equity financing. Consider consulting with a financial advisor to explore small business financing options.

- Compare potential returns and risks. Use opportunity cost analysis tools and prioritize options aligning with your business strategy. Consider short-term vs long-term financing costs and calculate the true cost of business loans.

- Evaluate long-term impacts. Analyze scenarios for business growth, cash flow, and customer retention. Assess the cash flow impact of financing deals and consider tax implications of business financing.

Explanation:

Taking these steps helps you understand the trade-offs of different financing options, ensuring you choose the most beneficial one when evaluating promotional financing costs.

For more insights, visit Stenn’s blog on opportunity cost.

By assessing opportunity costs and comparing different financing structures, you ensure your financing choices support your business’s growth and profitability.

5: Review customer retention impact of financing

Understanding how financing affects customer retention is crucial for sustained business growth when evaluating promotional financing costs.

Actionable Steps:

- Analyze customer retention strategies. Assess how different small business financing options impact marketing budgets and loyalty programs.

- Implement customer feedback mechanisms. Use surveys, focus groups, and social media to gauge customer responses to your financing strategy, including their perception of hidden fees in promotional financing.

- Monitor key metrics. Track metrics like customer lifetime value (CLV) and repeat purchase rates using data analytics tools, considering the cash flow impact of financing deals.

Key metrics to track for customer retention:

- Customer Lifetime Value (CLV)

- Churn rate

- Net Promoter Score (NPS)

Explanation:

Taking these steps helps you understand and mitigate the impact of financing on customer retention. Monitoring customer feedback and key metrics ensures you make informed adjustments when evaluating promotional financing costs.

For more insights on customer retention, visit Business.com. By evaluating customer retention impacts, you can align your financing strategies with your customer satisfaction goals and long-term growth plans, considering both short-term vs long-term financing costs.

This approach ensures you maintain a loyal customer base while managing your financing effectively, including carefully reading the fine print in loan agreements.

Partner with Alleo to Uncover Hidden Costs

We’ve explored evaluating hidden costs in promotional financing and how to navigate them. But did you know Alleo can simplify this process of evaluating promotional financing costs for you?

Set up an account with Alleo to create a personalized plan. Work with Alleo’s AI coach to overcome financing challenges, including understanding hidden fees in promotional financing and calculating the true cost of business loans.

Receive regular follow-ups, progress checks, and accountability via text and push notifications to help you compare different financing structures and assess the cash flow impact of financing deals.

Ready to get started for free? Let me show you how to explore small business financing options!

Step 1: Log In or Create Your Account

To start uncovering hidden costs in promotional financing, log in to your Alleo account or create a new one to access personalized guidance from our AI coach.

Step 2: Choose Your Financial Goal

Click on “Setting and achieving personal or professional goals” to focus on uncovering hidden costs in promotional financing, aligning with your business’s financial health and growth objectives.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in the Alleo AI coach to specifically address your challenges with promotional financing and hidden costs, allowing you to receive tailored guidance on managing your business’s financial health and growth.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to discuss your financial goals and create a personalized plan for evaluating promotional financing options for your small business.

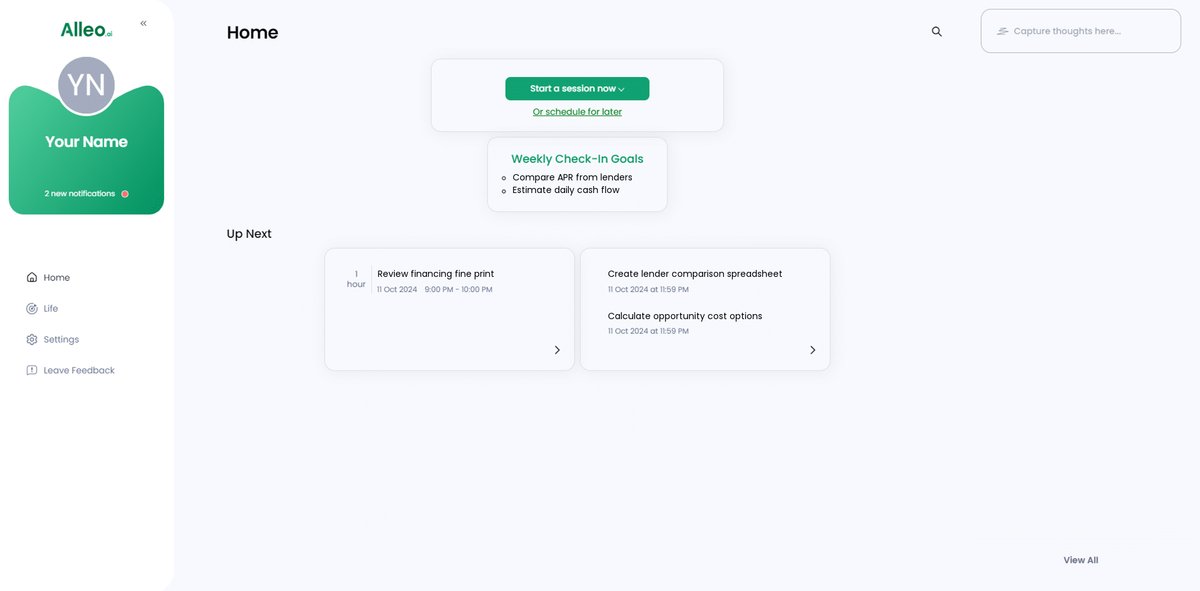

Step 5: Viewing and Managing Goals After the Session

After your coaching session on evaluating promotional financing, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress in uncovering hidden costs and making informed decisions for your business.

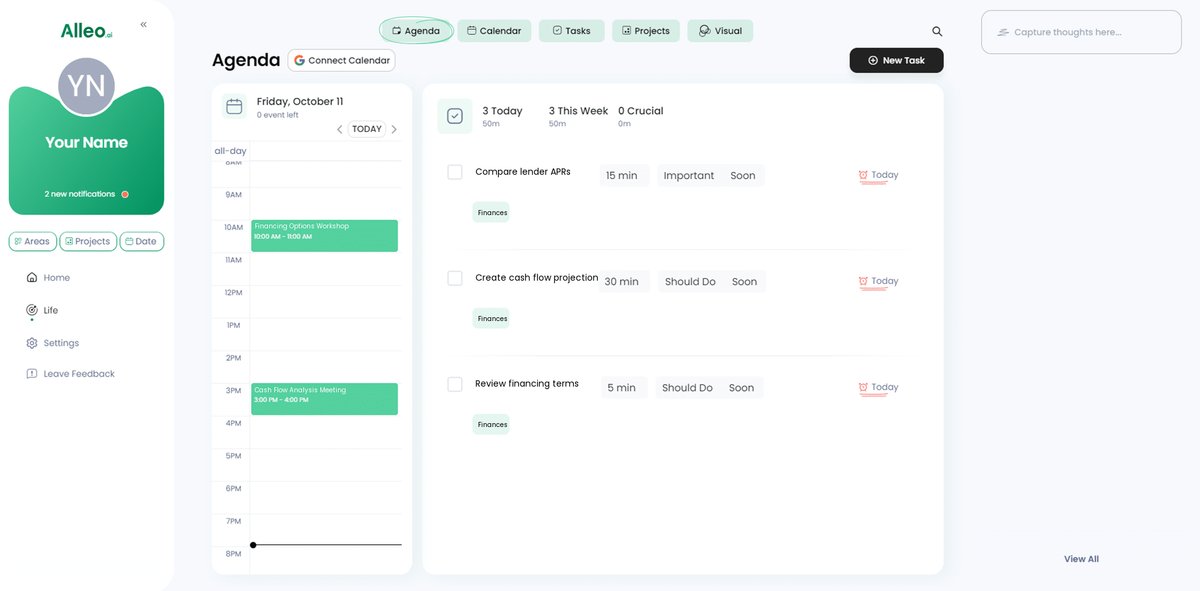

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your progress in evaluating promotional financing options, helping you stay organized and accountable as you work through each step of uncovering hidden costs.

Bringing It All Together: Your Path to Financial Clarity

As we wrap up, let’s revisit the key steps for evaluating promotional financing costs and uncovering hidden fees in promotional financing.

By comparing APR and fees, calculating cash flow impacts, analyzing repayment terms, assessing opportunity costs, and reviewing customer retention impacts, you can make informed decisions when evaluating small business financing options.

I understand the challenges you face as a small business owner when it comes to calculating the true cost of business loans.

With a clear strategy, you can navigate these complexities, including comparing different financing structures and reading the fine print in loan agreements, to safeguard your financial health.

Remember, you don’t have to do this alone. Alleo can help you evaluate financing options, including business credit card promotional offers and short-term vs long-term financing costs, to achieve your business goals.

Start your journey with Alleo today and take control of your financial future by thoroughly evaluating promotional financing costs.